Cheap BMW X1 Car Insurance in 2026 (Save Big With These 10 Companies!)

Discover the best options for cheap BMW X1 car insurance with top picks Progressive, American Family, and USAA, starting as low as $45 monthly. These providers excel in affordability, offering comprehensive coverage and exceptional customer service tailored to your BMW X1 needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated November 2024

Company Facts

Min. Coverage for BMW X1

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for BMW X1

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for BMW X1

A.M. Best

Complaint Level

Pros & Cons

The top picks for cheap BMW X1 car insurance are Progressive, American Family, and USAA, known for their affordable rates and robust coverage options.

These companies stand out in the competitive insurance market by combining comprehensive protection with excellent customer service.

Our Top 10 Company Picks: Cheap BMW X1 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $45 A+ Usage-Based Progressive

![]()

#2 $48 A Teen Driver American Family

![]()

#3 $50 A++ Military Benefits USAA

![]()

#4 $54 A++ Low Rates Geico

#5 $55 B Comprehensive Discounts State Farm

#6 $57 A++ Hybrid Discounts Travelers

#7 $58 A+ Accident Forgiveness Nationwide

#8 $60 A+ New Car Allstate

#9 $62 A Customization Options Farmers

#10 $65 A Lifetime Repair Liberty Mutual

Choosing the right insurer for your BMW X1 not only involves comparing prices but also considering the quality of coverage and the company’s reputation for claims service. Whether you’re a new buyer or looking to switch providers, these companies offer the best value and security for BMW X1 owners. Learn more in our “Full Coverage Car Insurance: A Complete Guide.”

Enter your ZIP code above to start comparing premiums from highly-rated insurers in your area.

- Progressive is the top pick for cheap BMW X1 car insurance

- BMW X1 owners require comprehensive coverage for high-value parts

- Ensuring your BMW X1 includes safety feature discounts can lower premiums

</ul>

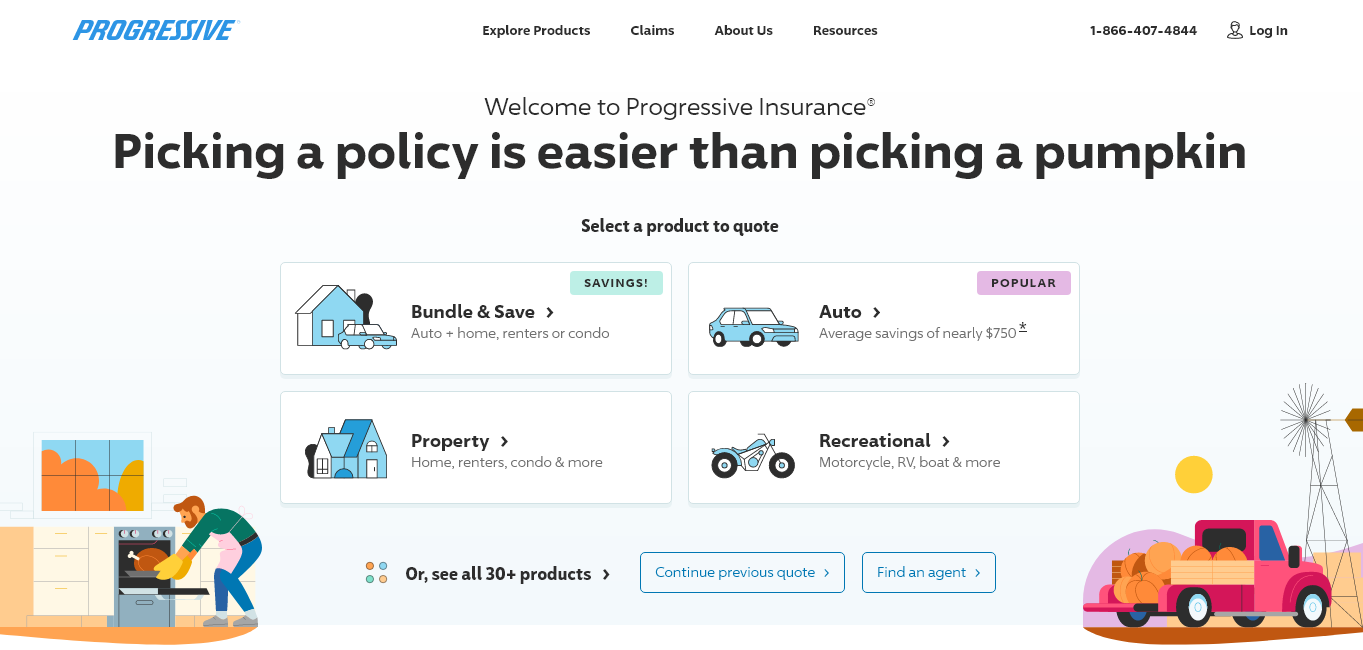

#1 – Progressive: Top Overall Pick

Pros

- Snapshot Program: Progressive offers a usage-based insurance program that can lead to significant savings for safe drivers.

- Competitive Rates: Progressive has some of the lowest rates, starting at $45 monthly. Discover insights in our Progressive car insurance review & ratings.

- Strong Financial Rating: With an A+ rating from A.M. Best, Progressive is financially stable and reliable.

Cons

- Varying Customer Service: Customer service quality can vary widely depending on the region.

- Rate Fluctuations: Some customers report rate increases after the initial policy term.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Teen Driver

Pros

- Teen Safe Driver Program: American Family offers a program that encourages safe driving habits for teens.

- Affordable Rates for Teens: Known for offering competitive rates for young drivers at $48 monthly.

- Robust Coverage Options: Wide range of coverage that can be tailored for different family needs. Unlock details in our American Family insurance review & ratings.

Cons

- Availability: Coverage is not available in all states.

- Discount Dependency: Best rates are typically available only with multiple discounts.

#3 – USAA: Best for Military Benefits

Pros

- Military-Specific Benefits: USAA offers benefits and discounts tailored to service members and their families.

- Exceptional Customer Service: Known for outstanding customer support and handling of claims. Delve into our evaluation of USAA insurance review & ratings.

- Top-Notch Financial Stability: Highest A++ rating from A.M. Best, indicating superior financial health.

Cons

- Limited Eligibility: Services are only available to military members, veterans, and their families.

- Less Competitive for Non-Military: Non-military members may find better rates elsewhere.

#4 – Geico: Best for Low Rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros

- Competitive Pricing: Offers some of the lowest car insurance rates, starting at $54 monthly.

- Extensive Discounts: Wide array of discounts available, including for safe driving and vehicle safety features.

- Mobile App Functionality: High-rated mobile app for easy policy management. Access comprehensive insights into our Geico car insurance discounts.

Cons

- Personalized Customer Care: Some users report less personalized service due to the company’s size.

- Coverage Variability: Coverage details and options can vary significantly by state.

#5 – State Farm: Best for Comprehensive Discounts

Pros

- Bundling Policies: Significant discounts available for bundling multiple insurance policies.

- High Low-Mileage Discount: Substantial discounts for drivers with low annual mileage.

- Wide Coverage: Diverse insurance options tailored to various needs. Discover more about offerings in our State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: Discounts not as competitive as some rivals.

- Premium Costs: Higher rates for certain coverage levels despite discounts.

#6 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Vehicle Discounts: Special rates for hybrid vehicles, encouraging eco-friendly driving.

- IntelliDrive Program: Usage-based program that can reduce premiums based on driving behavior.

- Coverage Options: Offers a wide range of customizable coverage options. Check out insurance savings in our complete Travelers insurance review & ratings.

Cons

- Higher Base Rates: Generally higher starting rates compared to competitors.

- Complex Claims Process: Some customers report a more cumbersome claims process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness policies, preventing rate increases after your first accident.

- Vanishing Deductible: Option to reduce your deductible over time with safe driving.

- Multiple Discounts: Offers various discounts for bundling, safe driving, and more. Read up on the “Nationwide Insurance Review & Ratings” for more information.

Cons

- Customer Satisfaction: Some reports of below-average customer satisfaction in handling claims.

- Rate Adjustments: Potential for rate increases at renewal, especially post-claim.

#8 – Allstate: Best for New Car

Pros

- New Car Replacement: Allstate offers new car replacement, protecting your investment in a new vehicle.

- Safe Driving Bonus: Provides bonuses for safe driving, including deductible rewards. See more details on our Allstate insurance review & ratings.

- Variety of Coverages: Extensive coverage options including standard and optional add-ons.

Cons

- Higher Premiums: Generally higher premiums compared to other insurers.

- Policy Upselling: Some customers report frequent upselling of additional coverages.

#9 – Farmers: Best for Customization Options

Pros

- Customizable Options: Farmers offers highly customizable policies to meet specific driver needs. Learn more in our Farmers car insurance review & ratings.

- Incident Forgiveness: Policies include forgiveness for small incidents to prevent premium increases.

- Diverse Discounts: Variety of discounts available, including for professional groups and safety features.

Cons

- Costlier Premiums: Higher premiums than some competitors, especially without discounts.

- Complex Policies: Some customers find the policy options and coverages complex to navigate.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Lifetime Repair

Pros

- Lifetime Repair Guarantee: Liberty Mutual offers a lifetime guarantee on all vehicle repairs made through their service.

- Accident Forgiveness: Available as an add-on to prevent rates from increasing after your first accident.

- RightTrack Refund: Provides a refund based on your driving behavior, promoting safe driving habits. If you want to learn more about the company, head to our Liberty Mutual car insurance review & ratings.

Cons

- Higher Rates: Generally higher rates that may not compete well with lower-cost providers.

- Inconsistent Customer Service: Customer service quality can vary, affecting the overall satisfaction.

Comparative Monthly Rates for BMW X1: Minimum vs. Full Coverage

When selecting car insurance for a BMW X1, the cost can vary significantly depending on whether you choose minimum or full coverage. This section outlines the monthly rates from various providers to help you make an informed decision.

Car Insurance Monthly Rates for BMW X1 by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $140

American Family $48 $125

Farmers $62 $145

Geico $54 $128

Liberty Mutual $65 $150

Nationwide $58 $135

Progressive $45 $115

State Farm $55 $130

Travelers $57 $138

USAA $50 $120

The monthly rates for minimum coverage for the BMW X1 range from $45 with Progressive to $65 with Liberty Mutual. On the other hand, full coverage, which offers more comprehensive protection, sees its lowest price at $115 with Progressive and peaks at $150 with Liberty Mutual. Notably, companies like American Family and Geico offer competitive rates for full coverage at $125 and $128, respectively.

This diversity in pricing shows a significant spread in potential insurance costs, which could influence your decision depending on what type of coverage you prioritize: basic liability or extensive protection. Discover insights in our “Liability Insurance: A Complete Guide.”

Factors That Influence the Cost of BMW X1 Car Insurance

Several key factors can impact the cost of car insurance for your BMW X1. One major consideration is the model and year of your X1. Newer models may be more expensive to insure due to higher replacement costs in case of an accident. The engine size and power of your BMW X1 can also affect the insurance premium, as more powerful engines may pose a higher risk on the road.

Other influential factors include your driving record and personal circumstances. If you have a clean driving history with no accidents or traffic violations, you are likely to qualify for lower insurance rates. On the other hand, a history of accidents or traffic violations can increase your insurance premiums. Additionally, factors such as your age, gender, and where you live can also affect the cost of your BMW X1 car insurance.

Jeff Root Licensed Life Insurance Agent

Insurance companies also consider the level of coverage you choose for your BMW X1. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, can raise your insurance costs compared to basic liability coverage. Unlock details in our “Does my car insurance cover damage caused by a natural disaster if I only have liability coverage?”

Another factor that can influence the cost of car insurance for your BMW X1 is your credit score. Insurance companies often use credit-based insurance scores to determine premiums. A lower credit score may result in higher insurance rates, as it is seen as an indicator of higher risk.

The mileage you put on your BMW X1 can also impact your insurance costs. Insurance companies may consider the average annual mileage of your vehicle when calculating premiums. Higher mileage can increase the likelihood of accidents and therefore lead to higher insurance rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Insurance Coverage Options for the BMW X1

When insuring your BMW X1, it’s essential to understand the different coverage options available. The two primary types of coverage are liability insurance and comprehensive insurance.

Liability insurance is legally required in most states and covers damages and injuries to others if you are at fault in an accident. This coverage includes bodily injury liability, which pays for injuries to other people, and property damage liability, which covers damages to other vehicles or property.

Comprehensive insurance, on the other hand, provides coverage for damages to your BMW X1 caused by events other than a collision. This can include theft, vandalism, fire, or natural disasters. Comprehensive insurance offers greater protection but comes with a higher cost. Delve into our evaluation of “Collision Car Insurance: A Complete Guide.”

It’s crucial to consider your needs and assess the risks involved in owning a BMW X1 to determine the appropriate coverage for your vehicle.

When selecting insurance coverage for your BMW X1, it’s also important to understand the concept of deductibles. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your BMW X1 sustains $2,000 worth of damages, you would need to pay the first $500, and your insurance would cover the remaining $1,500.

Tips for Finding Affordable Car Insurance for Your BMW X1

Finding affordable car insurance for your BMW X1 can be a daunting task, but with the right approach, you can secure a reasonable premium. Here are some tips to help you find affordable car insurance:

- Compare Quotes From Multiple Insurers: Each provider evaluates risk differently, and rates can vary significantly.

- Bundle BMW X1 Insurance: Many insurance companies offer multi-policy discounts that can save you money.

- Utilize Available Discounts: Insurance companies often provide discounts for safe driving records, completing defensive driving courses, or having certain safety features in your vehicle.

- Maintain a Good Credit Score: Insurance companies often use credit score as a factor in determining premiums, so improving your credit score can help lower your insurance costs.

- Increase Your Deductibles: Choosing a higher deductible can lower your monthly premium, but be sure to select a deductible that you can comfortably afford to pay in case of a claim. Access comprehensive insights into our “What is the difference between a deductible and a premium in car insurance?“

- Join a Car Insurance Group: Some organizations offer group discounts on car insurance for their members. Research if there are any groups or associations that you qualify for and inquire about any potential discounts they may offer.

To secure affordable car insurance for your BMW X1, exploring various discounts and customizing your policy to fit your needs is key. By thoroughly comparing quotes, bundling policies, and maintaining a strong credit score, you can find a premium that balances cost with comprehensive coverage.

Comparing Car Insurance Rates for the BMW X1 Across Different Providers

When searching for car insurance for your BMW X1, it is crucial to compare rates from different providers to ensure you are getting the best deal. Each insurance company uses different factors to determine premiums, so the rates can vary significantly.

Start by gathering quotes from several insurance providers and comparing the coverage options they offer. Consider the level of coverage, deductibles, and any additional benefits included in the policy. It’s also important to assess the reputation and customer satisfaction ratings of the insurance companies you are considering.

Laura Walker Former Licensed Agent

In addition to comparing rates, explore the specific discounts and savings opportunities each insurance provider offers. Some providers may offer discounts specifically for luxury vehicles like the BMW X1 or for certain safety features installed in the car. Discover more about offerings in our “New Car Insurance Discount.”

While comparing rates, be aware of the trade-off between cost and coverage. Choosing the cheapest option may save you money upfront but could leave you underinsured in case of an accident. Striking the right balance between cost and coverage is key to finding the best car insurance for your BMW X1.

Another important factor to consider when comparing car insurance rates for the BMW X1 is the level of customer service provided by each insurance provider. Look for companies that have a reputation for excellent customer service and prompt claims handling. This can make a significant difference in your overall experience with the insurance company.

Furthermore, it is worth exploring any additional coverage options that may be available for your BMW X1. Some insurance providers offer specialized coverage for luxury vehicles, such as coverage for high-end audio systems or custom modifications. Assess your specific needs and preferences to determine if these additional coverage options are worth considering.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code below.

Frequently Asked Questions

What factors affect the cost of BMW X1 car insurance?

The cost of BMW X1 car insurance can be influenced by several factors, including the driver’s age, driving history, location, coverage options, deductible amount, and the model year of the car.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?“

Are BMW X1 cars expensive to insure?

BMW X1 cars are generally considered to be in the mid-range when it comes to insurance costs. However, the actual insurance premium can vary depending on individual circumstances and factors mentioned earlier.

Does the cost of BMW X1 car insurance differ based on the model year?

Yes, the model year of the BMW X1 can impact the cost of insurance. Generally, newer models may have higher insurance premiums due to their higher value and potentially costlier repairs or replacement parts.

What are some ways to potentially lower the cost of BMW X1 car insurance?

There are several strategies to help reduce the cost of BMW X1 car insurance. These include maintaining a clean driving record, opting for a higher deductible, bundling car insurance with other policies, taking advantage of available discounts, and comparing quotes from multiple insurance providers.

Do insurance rates for the BMW X1 vary by location?

Yes, insurance rates for the BMW X1 can vary based on the location of the insured individual. Factors such as local crime rates, population density, and traffic conditions can influence insurance premiums in different regions.

To find out more, explore our guide titled “Does my car insurance cover damage caused by a DUI or other criminal activity?“

How can I get a quote for BMW X1 insurance price from AIG Insurance?

To get a quote for the BMW X1 insurance price, you can visit AIG Insurance’s website, contact them directly via phone, or consult with one of their authorized agents.

Is AIG Insurance a good choice for BMW X1 insurance price?

Yes, AIG Insurance is a reputable provider known for offering competitive rates and comprehensive coverage options, making it a good choice for BMW X1 insurance.

Is the BMW X1 a reliable car?

The BMW X1 proves to be a reliable choice in the family SUV category. It ranked 10th out of 34 vehicles, with its petrol-engine models receiving an impressive 95% score. While it scored lower than the Skoda Karoq and Volvo XC40, it still outperformed the Audi Q3 and Mercedes GLE.

What are the benefits of choosing AIG Insurance for BMW X1?

Choosing AIG Insurance for your BMW X1 comes with benefits such as extensive coverage options, potential discounts, and the backing of an insurer with a strong financial rating.

To learn more, explore our comprehensive resource on “Lesser Known Car Insurance Discounts.”

What is the cheapest BMW to insure?

The BMW 2 Series is often the most affordable BMW to insure, largely because it’s also one of the least expensive models to purchase. Opting for the base trim not only helps to reduce the initial buying cost but also tends to lower insurance expenses, making a standard BMW 2 Series typically cost-effective to insure.

How many miles can an X1 last?

Is the BMW X1 a real BMW?

Why BMW repairs are expensive?

Are BMW cars a good investment?

Are BMWs the safest cars?

What is the best model of BMW to buy used?

Can BMW X1 last for 10 years?

Are BMWs reliable after 100k miles?

What is the common problem in BMW X1?

Is a BMW a high risk car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.