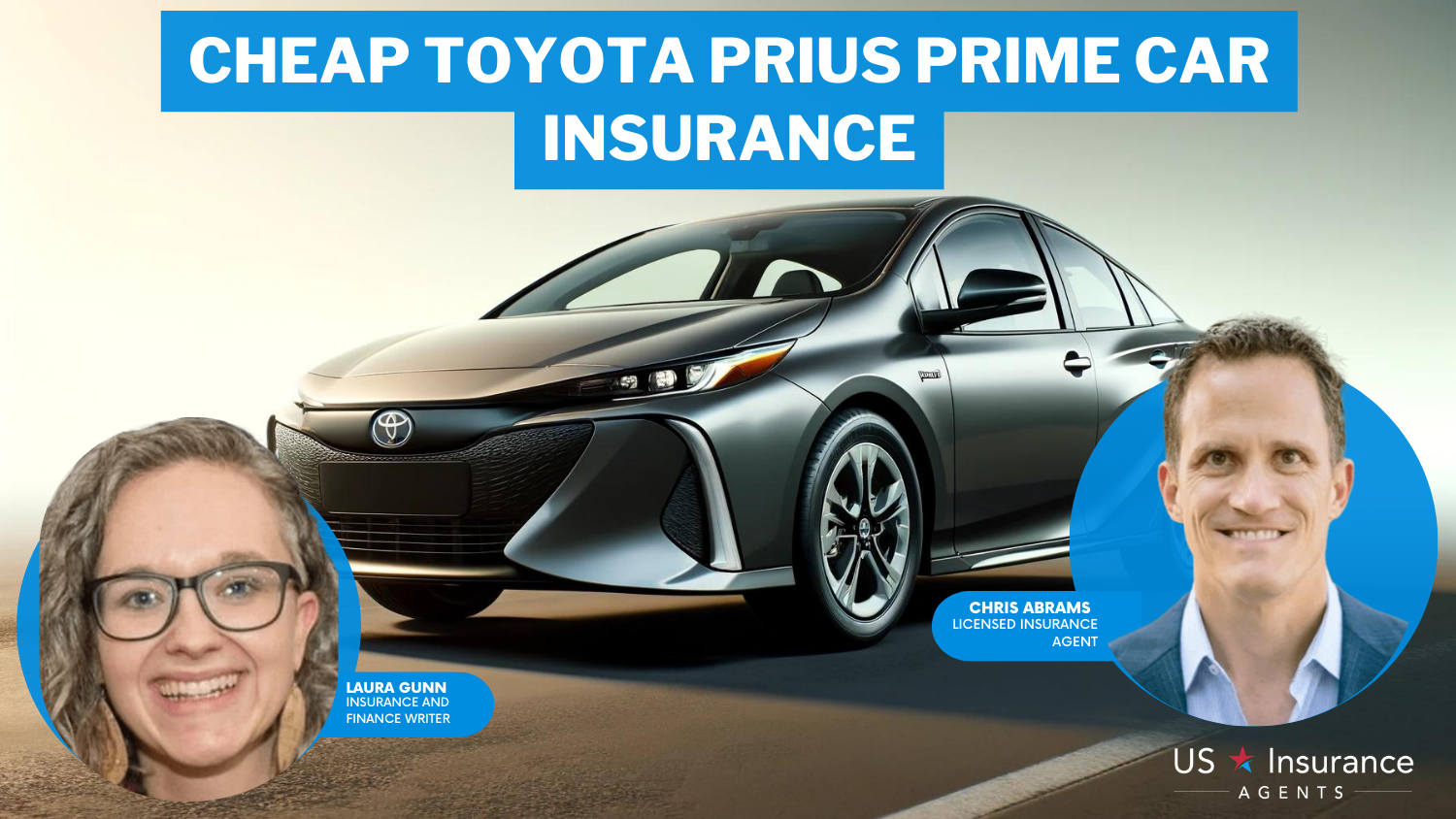

Cheap Toyota Prius Prime Car Insurance in 2026 (Earn Savings With These 10 Companies)

Nationwide, State farm, and USAA stand out as the best providers for cheap Toyota Prius Prime car insurance. Nationwide offers the lowest rates, starting at just $78 per month. These companies provide excellent options and discounts, ensuring Toyota Prius Prime owners get affordable and comprehensive insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

Company Facts

Min. Coverage for Toyota Prius Prime

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Prius Prime

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Prius Prime

A.M. Best

Complaint Level

Pros & Cons

Nationwide, State Farm, and USAA are the top providers for cheap Toyota Prius Prime car insurance, offering the best rates and coverage options.

Car insurance is a crucial aspect of owning a vehicle, and the Toyota Prius Prime is no exception. As an environmentally-friendly and fuel-efficient car, the Toyota Prius Prime comes with its own set of insurance considerations.

Our Top 10 Company Picks: Cheap Toyota Prius Prime Car Insurance

Company Rank Monthly Rates Multi-Policy Discount Best For Jump to Pros/Cons

![]()

#1 $78 10% Cost Efficiency State Farm

#2 $83 17% Broad Coverage Nationwide

![]()

#3 $85 10% Military Members USAA

#4 $87 14% Tech Savvy Geico

#5 $90 12% Top Service Erie

#6 $92 15% Claims Handling Auto-Owners

#7 $96 12% Multiple Discounts Progressive

#8 $100 11% Young Families American Family

#9 $104 10% Comprehensive Plans Liberty Mutual

#10 $108 10% Senior Drivers The General

If you own a Toyota Prius Prime, it’s important to understand factors affecting its insurance rates and coverage options. To find the best rates, consider getting insurance quotes online to compare providers and secure a policy that fits your needs. Enter your ZIP code now.

#1 – Nationwide: Top Overall Pick

Pros

- Affordable Rates: Starting at $83 per month, Nationwide offers competitive rates specifically for Toyota Prius Prime owners, making it a great option for cost-conscious drivers. This affordability helps keep overall insurance costs low for hybrid vehicle owners, as detailed in the Nationwide insurance review & ratings.

- Broad Coverage Options: Nationwide provides a range of coverage options including hybrid-specific coverage for Prius Prime drivers, ensuring that unique needs are met. Their comprehensive policies can be tailored to hybrid vehicle requirements.

- Strong Customer Service: Known for responsive and helpful customer service, Nationwide ensures that Prius Prime owners receive effective support for any insurance needs. Their customer service is reliable for managing hybrid vehicle claims.

Cons

- Limited Local Agents: Availability of local agents may be limited in some areas, potentially impacting Prius Prime owners’ ability to receive personalized, face-to-face service. This could affect customer experience for those who prefer in-person interactions.

- Basic Coverage Options: Some optional coverage enhancements may be less extensive compared to competitors, potentially leaving gaps in protection for Toyota Prius Prime drivers. This could affect coverage for hybrid-specific needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Broad Coverage

Pros

- Extensive Network: State Farm’s extensive network of agents across the country provides personalized service for Toyota Prius Prime owners, making it easier to find local assistance. Their broad reach ensures accessibility for hybrid vehicle drivers.

- Customizable Coverage Options: State Farm offers a range of coverage options that can be tailored to the specific needs of Prius Prime owners, including hybrid vehicle considerations. This flexibility allows for a more customized insurance plan, as highlighted in the State Farm insurance review & ratings.

- 10% Multi-Policy Discount: Offers a 10% discount when bundling policies, which can reduce overall costs for Prius Prime enthusiasts with multiple insurance needs. This discount helps in managing overall insurance expenses.

Cons

- Higher Rates in Some Areas: Insurance rates may be higher depending on location and local market conditions, potentially affecting Toyota Prius Prime owners in certain regions. This variability can impact premium affordability.

- Customer Service Variability: Quality of customer service can vary depending on the agent and location, which might affect the experience of Prius Prime drivers. Inconsistent service could impact customer satisfaction.

#3 – USAA: Best for Military Members

Pros

- Best Rates for Military Members: USAA offers some of the most competitive rates for Toyota Prius Prime owners who are military members, starting at $85 per month. This makes it an excellent option for military families with hybrid vehicles.

- Efficient Claims Handling: Known for reliable and swift claims processing, USAA ensures that Prius Prime drivers experience efficient and fair claim resolutions. This efficiency is valuable for managing hybrid vehicle claims, as noted in the USAA insurance review & ratings.

- High Customer Satisfaction: USAA has a strong reputation for customer satisfaction, providing exceptional service to Toyota Prius Prime enthusiasts. Positive reviews reflect their commitment to quality service.

Cons

- Eligibility Restrictions: USAA is available only to military members, veterans, and their families, which limits access for non-military Toyota Prius Prime owners. This exclusivity may exclude some potential customers.

- Limited Regional Availability: Not available in all states, which could affect Prius Prime drivers in areas where USAA does not operate. This limitation may impact coverage options for some hybrid vehicle owners.

#4 – Geico: Best for Tech Savvy

Pros

- Tech-Savvy Features: Geico offers advanced mobile apps and online tools that are beneficial for Toyota Prius Prime drivers, providing convenient management of your hybrid vehicle insurance. Their tech features enhance ease of use.

- Affordable Rates: Provides competitive insurance rates, starting at $87 per month, making it a cost-effective option for Prius Prime owners. This affordability is especially attractive for budget-conscious drivers.

- 14% Multi-Policy Discount: Geico offers a substantial multi-policy discount, which can lead to savings for Prius Prime enthusiasts with multiple insurance policies. This discount helps lower overall insurance costs.

Cons

- Basic Coverage Options: Some coverage options may be less comprehensive, potentially lacking specific enhancements for hybrid vehicles like the Prius Prime. This could impact coverage adequacy.

- Less Personalized Service: Geico’s standardized approach may not offer the same level of personalization as other providers, potentially affecting Prius Prime owners seeking more tailored service. This might impact customer experience. Learn more through “How can I pay my Geico insurance premium?“

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Top Service

Pros

- Top-Notch Customer Service: Erie is known for exceptional customer service, offering personalized assistance to Toyota Prius Prime owners and ensuring prompt resolution of any insurance issues. Their service is highly rated for hybrid vehicle support, as highlighted in the Erie Insurance Review & Ratings.

- Accident Forgiveness: Includes accident forgiveness options, which can benefit Prius Prime drivers by preventing rate increases after an accident. This feature provides financial protection for hybrid vehicle owners.

- Varied Coverage Options: Offers a range of coverage options suitable for the unique needs of Prius Prime drivers, including hybrid-specific benefits. Their policies can be customized to meet specific needs.

Cons

- Regional Limitations: Coverage availability may vary by state, potentially limiting access for Toyota Prius Prime drivers in certain regions. This could affect insurance options for some hybrid vehicle owners.

- Potentially Higher Premiums: Rates may be higher compared to some competitors, depending on coverage and location, which could impact affordability for Prius Prime owners. This variability should be considered.

#6 – Auto-Owners: Best for Claims Handling

Pros

- Excellent Claims Handling: Highly rated for efficient and fair claims processing, Auto-Owners ensures a smooth experience for Toyota Prius Prime drivers. Their strong reputation in claims management is advantageous for hybrid vehicle owners.

- Comprehensive Coverage Options: Provides a broad range of coverage choices, including hybrid-specific endorsements, making it suitable for Prius Prime owners. Their policies cater to various needs and preferences, as highlighted in the Auto-Owners insurance review & ratings.

- 15% Multi-Policy Discount: Includes a 15% discount for bundling multiple policies, which can be significant for Prius Prime enthusiasts with diverse insurance needs. This discount helps manage overall costs.

Cons

- Regional Availability: Primarily available in certain states, which might limit options for Toyota Prius Prime drivers in regions where Auto-Owners does not operate. This geographic limitation could affect coverage.

- Policy Complexity: Some policy options may be complex, requiring careful review to ensure all hybrid vehicle needs are met. Understanding all available coverage options may be challenging.

#7 – Progressive: Best for Multiple Discounts

Pros

- Multiple Discounts: Offers a variety of discounts, including for safe driving and bundling, making it an affordable choice for Toyota Prius Prime owners. These discounts can lower insurance costs for hybrid vehicle drivers.

- Snapshot Program: Provides a usage-based insurance program that rewards safe driving behavior, which can benefit Prius Prime enthusiasts. The Snapshot program can help reduce rates based on driving habits.

- Wide Availability: Available in all states, offering comprehensive coverage options for Toyota Prius Prime drivers across the country. Their nationwide presence ensures accessibility for hybrid vehicle owners.

Cons

- Rate Fluctuations: Insurance rates may fluctuate based on driving behavior and other factors, which could impact premium stability for Prius Prime owners. Rate changes may affect overall costs, according to Progressive insurance review & ratings.

- Inconsistent Customer Service: Customer service experiences can vary, with reports of longer wait times affecting support quality. This variability may impact Prius Prime drivers seeking consistent assistan

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Young Families

Pros

- Family-Friendly Coverage: Offers policies designed for families, including multi-car discounts and bundling options that benefit Toyota Prius Prime owners with family needs. Their family-oriented benefits add value.

- 11% Multi-Policy Discount: Includes an 11% discount for bundling auto insurance with other policies, which is advantageous for Prius Prime enthusiasts with multiple insurance needs. This discount helps reduce overall costs.

- Strong Local Presence: Known for a network of local agents who offer personalized service, enhancing the experience for Toyota Prius Prime drivers. Their local support ensures tailored assistance.

Cons

- Higher Premiums: Rates can be higher compared to some competitors, which might affect affordability for Toyota Prius Prime owners, depending on location and coverage. Premium costs should be evaluated carefully, as highlighted in the American Family insurance review & ratings.

- Limited Availability: Not available in all states, potentially restricting access for Prius Prime drivers in regions where American Family does not operate. This could limit insurance options.

#9 – Liberty Mutual: Best for Comprehensive Plans

Pros

- Innovative Discounts: Offers innovative discounts, such as those for hybrid and electric vehicles, which can benefit Toyota Prius Prime owners. These discounts recognize the unique aspects of hybrid vehicles, as noted in the Liberty Mutual Review & Ratings.

- Customizable Coverage: Provides a range of coverage options that can be customized to meet the needs of Prius Prime drivers, including hybrid-specific protections. This flexibility enhances policy relevance.

- 12% Multi-Policy Discount: Offers a 12% discount for bundling policies, which can be advantageous for Prius Prime owners with multiple insurance needs. This discount helps manage overall costs.

Cons

- Complex Policy Options: Some policy options may be complex, requiring careful review to ensure all needs are met. Understanding all available coverage options may be challenging for Prius Prime drivers.

- Variable Customer Service: Customer service quality can vary, with some reports of slower response times. This variability might affect Prius Prime owners seeking consistent support.

#10 – The General: Best for Senior Drivers

Pros

- High Discounts for Bundling: Offers high discounts for bundling auto insurance with other policies, which can benefit Prius Prime owners with multiple insurance needs. This can lead to significant savings.

- Customizable Plans: Allows for extensive customization of insurance plans, making it easier for Prius Prime drivers to get coverage tailored to their specific needs. This flexibility is advantageous for hybrid vehicle owners.

- Strong Local Agent Network: Known for a robust network of local agents who provide personalized service, enhancing the experience for Toyota Prius Prime drivers. Local agents offer tailored support. Read more through our The General insurance review & ratings.

Cons

- Higher Rates in Some Areas: Premiums may be higher depending on location and coverage options, which could impact affordability for Toyota Prius Prime owners in certain regions. This variability should be considered.

- Mixed Customer Reviews: Customer service experiences can vary, with some reports of inconsistent support quality. This variability may affect Prius Prime drivers seeking reliable service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Toyota Prius Prime Car Insurance Rates

When it comes to determining car insurance rates for a Toyota Prius Prime, several factors come into play. Insurance companies take into account several variables to assess the risk associated with insuring a specific vehicle, and these factors can influence the price you pay for insurance coverage.

Toyota Prius Prime Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $100 $175

Auto-Owners $92 $168

Erie $90 $165

Geico $87 $162

Liberty Mutual $104 $180

Nationwide $78 $150

Progressive $96 $172

State Farm $83 $158

The General $108 $185

USAA $85 $160

One of the primary considerations is the value of the car. Since the Toyota Prius Prime is a relatively expensive vehicle, it may lead to higher insurance premiums compared to other more affordable cars. The cost to repair or replace the vehicle is one of the factors that contribute to this higher cost.

Another vital factor is the driver’s personal characteristics, such as age, gender, and driving history. Younger and inexperienced drivers usually face higher insurance rates due to their higher likelihood of accidents. Additionally, a driver’s history of accidents, traffic violations, and claims can also impact insurance premiums.

Understanding the Insurance Classification of the Toyota Prius Prime

Hybrid and electric vehicles are often viewed favorably by insurance companies since they are associated with lower fuel consumption and reduced environmental impact.

The Toyota Prius Prime’s hybrid technology and high safety ratings can work in your favor when it comes to insurance rates. However, it’s important to note that the specific classification and associated rates vary between different insurance providers. Enter your ZIP code now.

Comparing Car Insurance Quotes for the Toyota Prius Prime

When comparing quotes, be sure to consider factors such as the coverage limits, deductibles, and any additional features or benefits included in the policy. While price is an important consideration, it’s equally important to ensure that the policy adequately covers your needs and provides the necessary protection for your Toyota Prius Prime.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Average Cost of Car Insurance For a Toyota Prius Prime

It is important to note that the cost of car insurance for a Toyota Prius Prime can vary significantly depending on various factors previously discussed.

While it’s not possible to provide an exact figure for the average cost, based on the national average, you can expect to pay anywhere from $78 to $108 monthly to insure a Toyota Prius Prime.

Tim Bain

Licensed Insurance Agent

Remember, these estimates are just averages and individual rates may vary based on your specific circumstances, location, insurance provider, and coverage options. To get the most accurate rate for your needs, it’s important to compare car insurance quotes from multiple providers. This way, you can find the best coverage at the most competitive price for your unique situation. Enter your ZIP code now.

Frequently Asked Questions

What factors affect the cost of Toyota Prius Prime car insurance?

The cost of Toyota Prius Prime car insurance can be influenced by several factors, including the driver’s age, driving record, location, coverage options, deductible amount, and the insurance company’s pricing policies.

Are Toyota Prius Prime cars generally more expensive to insure compared to other vehicles?

Insurance rates for Toyota Prius Prime cars are typically higher than average due to factors such as their higher repair costs and advanced technology. However, insurance rates can vary depending on individual circumstances and the insurance provider. Enter your ZIP code now.

How can I find the most affordable insurance for my Toyota Prius Prime?

To find the most affordable insurance for your Toyota Prius Prime, it is recommended to shop around and compare quotes from multiple insurance companies.

Understanding the differences between collision vs. comprehensive car insurance can also help in making an informed decision about your coverage needs.

Additionally, maintaining a good driving record, considering higher deductibles, and exploring available discounts can help lower the insurance cost.

Does the location where I live affect the insurance cost for a Toyota Prius Prime?

Yes, the location where you live can impact the insurance cost for a Toyota Prius Prime. Areas with higher crime rates or higher instances of accidents may lead to increased insurance premiums.

Similarly, densely populated urban areas may also have higher insurance costs compared to rural areas.

Which insurance provider offers the lowest monthly rate for Toyota Prius Prime owners?

State Farm offers the lowest monthly rate for Toyota Prius Prime owners at $78. This makes it the top-ranked provider for cost efficiency. Enter your ZIP code now.

What is the best insurance provider for military members with a Toyota Prius Prime?

USAA is the best car insurance for 21 year old drivers who are military members with a Toyota Prius Prime. It offers a competitive monthly rate of $85 and a 10% multi-policy discount.

This makes USAA an excellent choice for young drivers looking to save on their car insurance while enjoying comprehensive coverage.

Which company provides the highest multi-policy discount for Toyota Prius Prime drivers?

Nationwide provides the highest multi-policy discount for Toyota Prius Prime drivers at 17%. This makes it an excellent option for those seeking broad coverage.

What makes Nationwide a good option for broad coverage for Toyota Prius Prime owners?

Nationwide offers a comprehensive range of coverage options and a substantial 17% multi-policy discount. With a monthly rate of $83, it balances affordability and extensive coverage. Enter your ZIP code now.

Why is Geico considered the best choice for tech-savvy Toyota Prius Prime enthusiasts?

Geico is considered the best choice for tech-savvy Toyota Prius Prime enthusiasts due to its advanced digital tools and user-friendly online services. It also offers a competitive monthly rate of $87 and a 14% multi-policy discount, making it an attractive option for those seeking full coverage car insurance.

What is the ranking and monthly rate of Progressive for Toyota Prius Prime car insurance?

Progressive is ranked #7 for Toyota Prius Prime car insurance with a monthly rate of $96. It is known for offering multiple discounts and a 12% multi-policy discount.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.