Cheap Jeep Gladiator Car Insurance in 2026 (10 Most Affordable Companies)

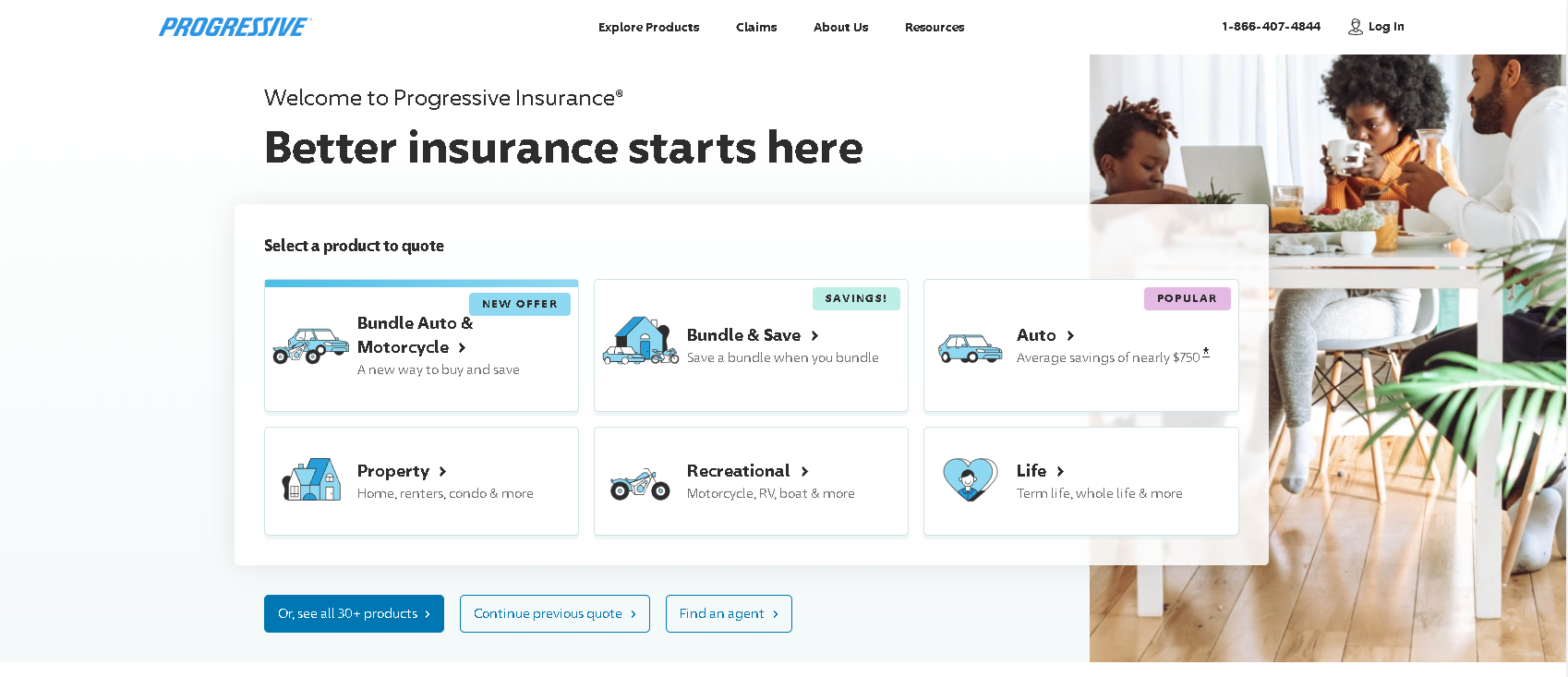

For cheap Jeep Gladiator car insurance, the best providers are Progressive, State Farm, and USAA, with Progressive offering rates starting at $39 per month. These companies stand out for their competitive rates, comprehensive coverage, and excellent customer service, making them top choices for auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Company Facts

Min. Coverage for Jeep Gladiator

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jeep Gladiator

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jeep Gladiator

A.M. Best

Complaint Level

Pros & Cons

The top three providers for cheap Jeep Gladiator car insurance, including Progressive, State Farm, and USAA, offer competitive rates, with Progressive starting at just $39 per month.

Our Top 10 Company Picks: Cheap Jeep Gladiator Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $39 A++ Flexible Options Progressive

#2 $41 B Customer Service State Farm

#3 $44 A++ Military Families USAA

#4 $46 A+ Coverage Options Allstate

#5 $49 A Nationwide Availability Kemper

#6 $53 A Online Convenience Liberty Mutual

#7 $56 A++ Local Agents American Family

#8 $59 A+ Personalized Service Erie

#9 $62 A+ Competitive Pricing Geico

#10 $65 A Variety of Discounts Travelers

Cheap Jeep Gladiator car owners can benefit from this combination of affordability and comprehensive coverage when choosing Progressive as their insurance provider.

Ready to shop around for the best car insurance company? Enter your ZIP code above and see which one offers the coverage you need.

- Progressive offers cheap Jeep Gladiator car insurance from $39/month

- Evaluate vehicle worth and discounts for cheap Jeep Gladiator car insurance

-

Compare cheap Jeep Gladiator car insurance quotes without sacrificing protection

#1 – Progressive: Top Pick Overall

Pros

- Advanced Technology Integration: The Progressive review and ratings highlights Snapshot, tracking driving habits to lower premiums for safe drivers, showcasing their innovative approach.

- Comprehensive Coverage: They provide a wide range of coverage options, including liability, collision, comprehensive, and more.

- Wide Variety of Discounts: The company attracts budget-conscious customers with various discounts like multi-policy, safe driver, and online quotes.

Cons

- Customer Service Concerns: Some customers have reported issues with customer service responsiveness.

- Limited Availability: Progressive may not be available in all states or areas, limiting coverage options for some customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Filing Claims

Pros

- Excellent Claims Process: State Farm is known for its efficient and easy-to-use claims filing process.

- Strong Community Involvement: The State Farm review and ratings emphasize its community involvement through charitable initiatives, highlighting its commitment to social responsibility.

- Innovative Digital Tools: State Farm offers cutting-edge digital tools and resources, making it easy for customers to manage their policies and file claims online.

Cons

- Higher Rates: While they offer quality service, State Farm’s premiums may be slightly higher compared to some competitors.

- Limited Discounts: State Farm may not offer as many discounts as other insurers, potentially reducing cost-saving opportunities for customers.

#3 – USAA: Best for Customer Service

Pros

- Exceptional Customer Service: USAA is renowned for its outstanding customer service and support for military members and their families.

- Member Benefits: USAA offers exclusive benefits and discounts to its members, including those serving in the military.

- Competitive Rates: USAA review & ratings feature a comprehensive range of coverage options, customized to individual needs, coupled with competitive rates.

Cons

- Eligibility Requirements: USAA membership is limited to military members, veterans, and their families, restricting access for the general public.

- Limited Coverage Options: While they excel in customer service, USAA may have fewer coverage options compared to larger insurers, potentially limiting customization for some customers.

#4 – Allstate: Strong Coverage Options and Discounts

Pros

- Wide Range of Coverage: Allstate offers a variety of coverage options, allowing customers to customize their policies to suit their needs.

- Discounts: They provide various discounts, such as multi-policy, safe driver, and anti-theft discounts, helping customers save on premiums.

- Comprehensive Mobile App: The Allstate review and ratings highlight their mobile app’s features like digital ID cards, roadside assistance, and easy claim filing, providing convenience for policyholders.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors, especially for certain coverage options.

- Mixed Customer Reviews: While many customers praise Allstate’s coverage options, some have reported issues with claims processing and customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Kemper: Customized Policies for Jeep Gladiator Owners

Pros

- Strong Customer Service: The Kemper insurance review and ratings highlight Kemper’s commitment to providing excellent customer service, ensuring that policyholders receive prompt assistance and support when needed.

- Competitive Rates: They provide competitive rates for cheap Jeep Gladiator car insurance, making them an attractive option for budget-conscious customers.

- Flexible Coverage: Kemper allows customers to customize their coverage limits and deductibles, providing flexibility in policy design.

Cons

- Limited Availability: Kemper’s insurance products may not be available in all states or areas, limiting coverage options for some customers.

- Mixed Customer Service: Some customers have reported varying experiences with Kemper’s customer service, with some praising it while others have encountered challenges.

#6 – Liberty Mutual: Robust Coverage and Financial Stability

Pros

- Robust Coverage: Liberty Mutual offers a wide range of coverage options, including comprehensive, collision, and liability coverage, providing thorough protection for cheap Jeep Gladiator car owners.

- Tailored Tech Integration: Liberty Mutual review and rating excel in integrating technology into its coverage, offering innovative solutions such as AI-driven claims processing and digital policy management.

- Discount Programs: They offer various discount programs, such as bundling discounts and good driver discounts, helping customers save on their premiums.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher compared to some competitors, particularly for certain coverage options.

- Customer Service: Some customers have reported mixed experiences with Liberty Mutual’s customer service, citing issues with claims processing and responsiveness.

#7 – American Family: Personalized Service and Dedication

Pros

- Personalized Service: American Family is known for providing personalized service, tailoring insurance solutions to meet individual customer needs.

- Strong Financial Stability: The American Family review & ratings offer a spectrum of coverage options uniquely crafted to match diverse individual requirements.

- Discount Opportunities: American Family provides various discount opportunities, such as loyalty discounts and safety equipment discounts, helping customers save on premiums.

Cons

- Limited Availability: Their insurance products may not be available in all states or regions, limiting coverage options for some customers.

- Premiums: Some customers may find American Family’s premiums to be slightly higher compared to other insurers, depending on the coverage options chosen.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Competitive Rates and Excellent Customer Satisfaction

Pros

- Competitive Rates: Erie offers competitive rates for insurance coverage, making them an attractive option for budget-conscious customers.

- Personalized Coverage Advisors: The Erie Insurance review & ratings spotlight its personalized approach designed to assist customers with their insurance plans.

- Policy Customization: Erie allows policy customization, enabling customers to tailor their coverage limits, deductibles, and add optional coverages as needed.

Cons

- Limited Availability: Erie’s insurance products are available in a limited number of states, which may restrict coverage options for customers in certain areas.

- Coverage Options: While Erie offers standard coverage options, they may not have as many additional coverage options or add-ons compared to some larger insurers.

#9 – Geico: Extensive Network and Online Convenience

Pros

- Extensive Network: Geico has a vast network of agents and service centers, making it easy for customers to access assistance and support when needed.

- Competitive Rates: Geico car insurance discounts indicate budget-friendly pricing options for cheap Jeep Gladiator car insurance.

- Policy Customization: Geico provides customizable policies, allowing customers to adjust coverage levels and add optional coverages according to their preferences.

Cons

- Customer Service: Some customers have reported mixed experiences with Geico’s customer service, citing issues with claims processing and communication.

- Policy Customization Limitations: While Geico offers customization, some customers may find fewer options for personalized coverage compared to other insurers.

#10 – Travelers: Flexibility and Range of Coverage Options

Pros

- Sustainability Initiatives: The Travelers review and ratings highlight its sustainability commitment through emissions reduction, green practices promotion, and conservation support.

- Range of Coverage Options: They provide a wide range of coverage options, including comprehensive, collision, liability, and additional coverage for enhanced protection.

- Discount Opportunities: Travelers offers various discount opportunities, such as multi-policy discounts and safety feature discounts, helping customers save on premiums.

Cons

- Higher Premiums: Travelers’ premiums may be higher compared to some competitors, particularly for customers seeking extensive coverage or add-on options.

- Claims Processing: Some customers have reported longer wait times and complexities in claims processing with Travelers, affecting overall customer satisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Factors that Affect the Cost of Cheap Jeep Gladiator Car Insurance

When seeking cheap Jeep Gladiator car insurance, it’s crucial to understand the various factors that can influence your insurance premiums. By being aware of these elements, you can make informed decisions that help you secure affordable coverage for your vehicle.

- Driver and Vehicle Factors: Younger drivers, higher annual mileage, the Jeep Gladiator’s value, and its safety features influence insurance rates. Safer vehicles may get discounts, while high-value ones often incur higher costs.

- Coverage and Usage: Comprehensive coverage and business use increase premiums. Personal use and basic liability coverage tend to be cheaper.

- Location and Insurance Provider: Urban areas and severe weather regions lead to higher premiums. Comparing quotes from multiple insurers helps find the best rates, considering factors like customer service and financial stability.

Understanding these factors is essential for finding affordable car insurance by vehicle for the cheap Jeep Gladiator. To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Best Car Insurance by Vehicle.”

Tracey L. Wells Licensed Insurance Agent & Agency Owner

By considering your driving habits, vehicle details, coverage needs, and comparing different insurers, you can achieve the most affordable and suitable insurance for your Jeep Gladiator.

Understanding the Insurance Premiums for the Cheap Jeep Gladiator

Understanding the factors that impact cheap Jeep Gladiator car insurance is crucial for owners seeking to minimize their insurance costs. Various elements, from the vehicle’s value to the driver’s history, play a role in determining premiums.

- Vehicle Value and Coverage: The Gladiator’s high market value raises premiums, and comprehensive coverage costs more than liability coverage.

- Policyholder Factors: Younger drivers, those with a history of accidents, and those choosing lower deductibles face higher premiums.

- Location and Discounts: Urban areas and severe weather regions increase costs; discounts for safety features and policy bundling can lower premiums.

By understanding these factors, cheap Jeep Gladiator owners can find car insurance with discounts that make it affordable. To gain further insights, consult our comprehensive guide titled “Lesser Known Car Insurance Discounts.”

Jeep Gladiator Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $46 $140

American Family $56 $155

Erie $59 $160

Geico $62 $165

Kemper $49 $145

Liberty Mutual $53 $150

Progressive $39 $135

State Farm $41 $138

Travelers $65 $170

USAA $44 $142

Comparing quotes, maintaining a clean driving record, and taking advantage of discounts are effective strategies to reduce insurance expenses.

Comparing Different Insurance Options for the Cheap Jeep Gladiator

When it comes to securing cheap Jeep Gladiator car insurance, it’s essential to compare different insurance options to find the coverage that best suits your needs and budget. Here are some key insurance options to consider for your Jeep Gladiator:

- Liability, Comprehensive, and Collision Coverage: Liability covers legal minimums for others’ damages, while Comprehensive protects against non-collision events, and Collision pays for accidents with vehicles or objects..

- Uninsured/Underinsured Motorist and Personal Injury Protection (PIP): Uninsured/Underinsured Motorist coverage protects in accidents with insufficiently insured drivers, while mandatory PIP covers medical expenses and lost wages for all, irrespective of fault.

- Additional Coverage Options: Roadside Assistance provides help with breakdowns such as flat tires and dead batteries. Rental Reimbursement covers the cost of a rental car while your cheap Jeep Gladiator is being repaired, ensuring you stay mobile without extra expenses.

- Deductible Choices: Selecting a higher deductible can lower your insurance premiums but requires you to pay more out-of-pocket in the event of a claim. It’s important to balance your financial situation with potential costs.

- Gap Insurance: Gap insurance covers the difference between your vehicle’s value and what you owe, crucial if your cheap Jeep Gladiator is totaled or stolen, preventing financial responsibility for the remaining loan or lease balance.

To find cheap Jeep Gladiator car insurance, consider your budget, driving habits, and desired protection level, including coverage options like Personal Injury Protection. For a comprehensive analysis, refer to our detailed guide titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

Consulting with an insurance agent and comparing quotes from multiple providers can help you select the best coverage at the most competitive price, ensuring your Jeep Gladiator is well-protected without breaking the bank.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for the Cheap Jeep Gladiator

Navigating the world of car insurance for your cheap Jeep Gladiator can be daunting, but with the right approach, finding affordable coverage is achievable. Here are some valuable tips to help you secure cost-effective insurance without sacrificing essential coverage.

- Compare Quotes: Don’t settle for the first quote you receive. Comparing quotes from multiple insurers allows you to find the best price for the coverage you need.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to unlock potential discounts and save money.

- Consider a Higher Deductible: While it means paying more out of pocket in the event of a claim, opting for a higher deductible can lead to lower monthly premiums. To delve deeper, refer to our in-depth report titled “How does the insurance company determine my premium?”

- Maintain a Clean Record: Safe driving not only keeps you and others safe on the road but can also result in lower insurance costs by demonstrating your responsible driving habits.

- Explore Discounts: Inquire about available discounts, such as those for safety features in your vehicle or for driving fewer miles. These discounts can add up to significant savings over time.

Finding affordable car insurance for your cheap Jeep Gladiator is about more than just the price tag; it’s about striking a balance between cost and coverage.

By following these tips and exploring your options, you can secure the insurance coverage you need without breaking the bank.

Case Studies: Choosing Affordable and Comprehensive Jeep Gladiator Car Insurance

These case studies highlight how different Jeep Gladiator owners prioritize affordability, comprehensive coverage, and exceptional service when choosing insurance providers.

- Case Study #1 – Affordable Coverage: John, a budget-conscious Jeep Gladiator owner, sought affordable insurance without compromising coverage. He evaluated factors like driving history, vehicle worth, and discounts to find cheap Jeep Gladiator car insurance that provided comprehensive protection within his budget.

- Case Study #2 – Comprehensive Benefits: Sarah, a Jeep Gladiator enthusiast, valued comprehensive coverage and reliable customer service. She prioritized finding an insurance provider offering tailored coverage options and excellent support, ensuring her Jeep Gladiator was well-protected.

- Case Study #3 – Exceptional Service: Michael, a military veteran and Jeep Gladiator owner, sought exceptional service and benefits. He prioritized a provider with a track record of serving military members, offering discounts and a seamless insurance experience for his vehicle.

Owners of Jeep Gladiators can find the best insurance solution by carefully evaluating their driving history, vehicle worth, and available discounts.

Daniel Walker Licensed Insurance Agent

Considering these factors helps them secure affordable and comprehensive coverage that meets their specific needs and budget. To learn more, explore our comprehensive resource on commercial auto insurance titled “Types of Car Insurance Coverage.”

The Bottom Line: Strategies for Affordable Jeep Gladiator Car Insurance

The article delves into the world of cheap Jeep Gladiator car insurance, examining the various factors that impact insurance premiums and offering strategies to secure affordable coverage. It emphasizes the importance of evaluating driving history, vehicle value, and available discounts to find optimal insurance solutions.

The article also includes case studies that illustrate how owners can navigate insurance complexities and find comprehensive coverage within their budget. It ultimately highlights the significance of comparing quotes, maintaining a clean driving record, and leveraging discounts to secure affordable insurance for Jeep Gladiators.

For additional details, explore our comprehensive resource titled “Car Insurance: A Complete Guide.”

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Why is the Jeep Gladiator performing well in terms of sales?

The Jeep Gladiator has been performing well in sales due to its unique combination of off-road capability and pickup truck utility, appealing to a wide range of buyers looking for adventure and versatility.

How much is the monthly payment typically for a Jeep Gladiator?

Monthly payments for a Jeep Gladiator can vary based on factors such as the model year, trim level, down payment, loan term, and interest rate. Find cheap car insurance quotes by entering your ZIP code below.

How much does a Jeep Gladiator cost on average?

The average cost of a Jeep Gladiator ranges from around $35,000 to $60,000, depending on the specific model, features, and dealership pricing. To gain profound insights, consult our extensive guide titled “Compare Car Insurance Quotes.”

Are Jeep Gladiators known for their longevity?

Yes, Jeep Gladiators are known for their durability and lasting performance, especially with regular maintenance and care. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

How is the Gladiator considered a genuine Jeep model?

The Gladiator is considered a real Jeep model because of its ruggedness, versatility, and heritage as part of the Jeep lineup, embodying the brand’s legacy of off-road excellence and durability.

Why is insurance higher on a Jeep Gladiator?

Insurance rates for Jeep Gladiators can be higher due to factors like the vehicle’s higher market value, off-road capabilities, and potential for more severe damage in accidents.

For a comprehensive overview, explore our detailed resource titled “How to Document Damage for Car Insurance Claims.”

How long can a Jeep Gladiator engine be expected to last?

With proper maintenance and care, a Jeep Gladiator’s engine can last well over 100,000 miles or more. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Why do dealers sometimes offer discounts on Gladiators?

Dealers may offer discounts on Jeep Gladiators as part of promotional offers, to clear inventory, or to attract more buyers to the dealership.

What are some common issues or problems reported with the Jeep Gladiator?

Common issues with the Jeep Gladiator include occasional electronic glitches, transmission concerns, and reports of premature rusting in certain conditions.

For a thorough understanding, refer to our detailed analysis titled “Collision vs. Comprehensive Car Insurance.”

How far can a Jeep Gladiator typically travel on a full tank of gas?

The fuel efficiency of a Jeep Gladiator can vary depending on driving conditions, but it can generally travel around 300 to 400 miles on a full tank of gas, depending on the model and driving habits.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.