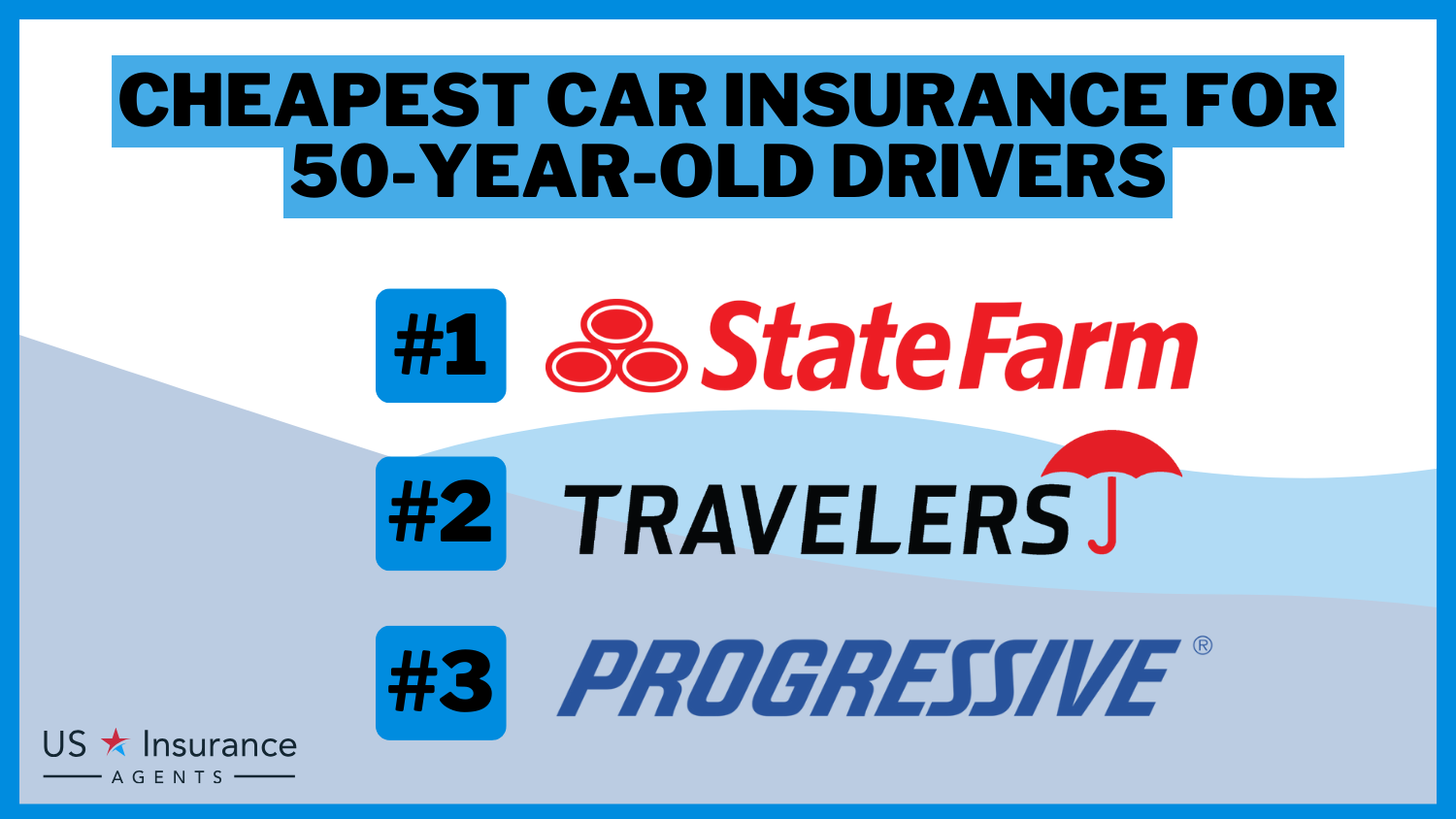

Cheapest Car Insurance for 50-Year-Old Drivers in 2026 (Save With These 10 Companies!)

State Farm, Travelers, and Progressive stand out as the top picks for the cheapest car insurance for 50-year-old drivers, with rates starting as low as $31 per month. These companies provide tailored coverage, ensuring affordable protection for drivers in their prime years.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated January 2025

18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for 50-Year-Old Drivers

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage for 50-Year-Old Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for 50-Year-Old Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsState Farm, Travelers, and Progressive emerge as the top picks for the cheapest car insurance for 50-year-old drivers. Boasting tailored coverage options designed specifically for this demographic, these companies offer comprehensive protection at competitive rates, ensuring peace of mind for drivers in their prime years.

Rounding out the trio is a company committed to providing personalized coverage options and excellent customer support.

Our Top 10 Company Picks: Cheapest Car Insurance for 50-Year-Old Drivers

| Company | Rank | Monthly Rates | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $31 | 7% | Many Discounts | State Farm | |

| #2 | $35 | 9% | Accident Forgiveness | Travelers | |

| #3 | $37 | 10% | Online Convenience | Progressive | |

| #4 | $41 | 12% | Student Savings | American Family | |

| #5 | $43 | 15% | 24/7 Support | MetLife | |

| #6 | $45 | 17% | Usage Discount | Nationwide |

| #7 | $48 | 18% | Policy Options | Esurance | |

| #8 | $50 | 25% | Local Agents | Farmers | |

| #9 | $58 | 28% | Add-on Coverages | Allstate | |

| #10 | $64 | 35% | Customizable Polices | Liberty Mutual |

With a keen focus on affordability and reliability, the top pick overall stands out for its exceptional customer service and customizable policies. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Rates for 50-Year-Old Drivers

Understanding specific coverage rates is crucial for 50-year-old drivers seeking the right car insurance. Balancing adequate protection and cost-efficiency is key. Let’s dive into the realm of coverage rates, distinguishing between Minimum and Full Coverage from prominent insurance providers.

Car Insurance for 50-Year-Old Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $58 | $152 |

| American Family | $41 | $111 |

| Esurance | $48 | $116 |

| Farmers | $50 | $131 |

| Liberty Mutual | $64 | $165 |

| MetLife | $43 | $109 |

| Nationwide | $45 | $109 |

| Progressive | $37 | $100 |

| State Farm | $31 | $82 |

| Travelers | $35 | $94 |

Understanding the Importance of Car Insurance for 50-Year-Old Drivers

Car insurance is essential for every driver, regardless of their age. It provides financial protection in the event of accidents or damage to your vehicle. As a 50-year-old driver, you have likely accumulated years of experience on the road, but that doesn’t mean you’re immune to accidents. Car insurance ensures that you have the necessary coverage to protect yourself and your vehicle.

Jeff Root Licensed Life Insurance Agent

One important aspect of car insurance for 50-year-old drivers is the potential for lower premiums. Insurance companies often consider age as a factor when determining insurance rates. As a 50-year-old driver, you may be eligible for lower premiums compared to younger drivers. This can help you save money while still maintaining the necessary coverage.

Additionally, car insurance for 50-year-old drivers may offer specific benefits tailored to your needs. For example, some insurance policies may include perks such as roadside assistance or coverage for rental cars. These additional benefits can provide peace of mind and convenience in case of emergencies or unexpected situations.

Factors That Affect Car Insurance Rates for 50-Year-Old Drivers

Many factors impact car insurance rates for 50-year-old drivers, including driving record, vehicle type, location, marital status, credit history, and mileage. Understanding these influences is key to lowering premiums. To gain further insights, consult our comprehensive guide titled “Car Driving Safety Guide for Teens and Parents.”

One factor that can affect car insurance rates for 50-year-old drivers is their occupation. Insurance companies may consider certain occupations to be less risky, resulting in lower premiums. For example, individuals in professions such as teaching or nursing may be eligible for discounts due to their perceived lower risk of accidents.

Car Insurance for 50-Year-Old Drivers: Monthly Rates by Age, Gender, & Provider

| Insurance Company | 20-Year-Old Female | 20-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $120 | $130 | $110 | $120 | $100 | $110 | $90 | $100 |

| American Family | $110 | $120 | $100 | $110 | $90 | $100 | $80 | $90 |

| Esurance | $115 | $125 | $105 | $115 | $95 | $105 | $85 | $95 |

| Farmers | $125 | $135 | $115 | $125 | $105 | $115 | $95 | $105 |

| Liberty Mutual | $130 | $140 | $120 | $130 | $110 | $120 | $100 | $110 |

| MetLife | $120 | $130 | $110 | $120 | $100 | $110 | $90 | $100 |

| Nationwide | $115 | $125 | $105 | $115 | $95 | $105 | $85 | $95 |

| Progressive | $110 | $120 | $100 | $110 | $90 | $100 | $80 | $90 |

| State Farm | $125 | $135 | $115 | $125 | $105 | $115 | $95 | $105 |

| Travelers | $120 | $130 | $110 | $120 | $100 | $110 | $90 | $100 |

Another factor that can impact car insurance rates for 50-year-old drivers is their level of education. Studies have shown that individuals with higher levels of education tend to have fewer accidents and file fewer claims. As a result, insurance companies may offer lower rates to drivers with advanced degrees or higher levels of education.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Age Plays a Role in Determining Car Insurance Premiums

Age is a significant factor when it comes to car insurance premiums. Generally, as drivers get older, their rates tend to decrease. This is because older drivers are often seen as more experienced, responsible, and less likely to engage in risky behaviors on the road. However, it’s important to note that individual factors such as driving history and vehicle type can still affect premiums for 50-year-old drivers.

Additionally, age can also impact car insurance premiums for younger drivers. Insurance companies often consider younger drivers to be more inexperienced and prone to car accidents, leading to higher premiums. This is especially true for teenage drivers who have limited driving experience. However, as these young drivers gain more experience and maintain a clean driving record, their premiums may gradually decrease over time.

Exploring Different Types of Car Insurance Coverage Options for 50-Year-Old Drivers

Understanding the types of car insurance coverage options is essential. Common types include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. As a 50-year-old driver, you can select options that suit your needs and budget.

Discounts tailored for experienced drivers may also be available, along with specialized coverage options like accident forgiveness or roadside assistance. Comparing quotes from different insurers ensures you find the best coverage at competitive prices.

Comparing Car Insurance Quotes for 50-Year-Old Drivers

Obtaining multiple car insurance quotes is an effective way to find the cheapest rates for 50-year-old drivers. It’s recommended to compare quotes from various insurance providers to ensure you’re getting the best possible deal. When comparing quotes, consider the coverage limits, deductibles, and any discounts that may be available to you.

Additionally, it’s important to review the reputation and customer service of the insurance providers you are considering. Look for reviews and ratings from other customers to get an idea of their satisfaction with the company. It’s also a good idea to check if the insurance provider has a convenient claims process and offers 24/7 customer support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding The Best Deals on Car Insurance For 50-Year-Old Drivers

To get the best car insurance, compare quotes from different providers and consider bundling with home insurance for discounts. Ask about safe driving and credit-related discounts, review coverage limits, and maintain a clean driving record for lower premiums.

Specialized programs for drivers aged 50+ offer tailored benefits like accident forgiveness and roadside assistance. Bundling policies can save money and provide convenience by managing everything with one insurer, simplifying claims processes. For detailed information, refer to our comprehensive report titled “Roadside Assistance Coverage: A Complete Guide.”

Exploring Discounts and Special Offers on Car Insurance for 50-Year-Old Drivers

Insurance companies often provide various discounts and special offers to attract customers. As a 50-year-old driver, you may be eligible for discounts based on your age, driving record, or completion of defensive driving courses. It’s worthwhile to inquire about these discounts when obtaining insurance quotes to maximize your savings.

Additionally, some insurance companies offer loyalty discounts to long-term customers. If you have been insured with the same company for a significant period of time, you may be eligible for a discount on your car insurance. It’s important to check with your insurance provider to see if they offer this type of discount and if you qualify.

How to Lower Your Car Insurance Premiums as a 50-Year-Old Driver

If you’re looking to lower your car insurance premiums, there are a few strategies you can employ. Firstly, maintaining a clean driving record is crucial. Avoid accidents and traffic violations to keep your rates low. Additionally, consider increasing your deductibles, as higher deductibles typically result in lower premiums. Finally, ask your insurance provider if there are any loyalty rewards or additional discounts you may qualify for.

Melanie Musson Published Insurance Expert

Another way to lower your car insurance premiums as a 50-year-old driver is to take advantage of any available discounts. Many insurance companies offer discounts for drivers who have completed defensive driving courses or have certain safety features installed in their vehicles, such as anti-lock brakes or airbags. Be sure to inquire with your insurance provider about these potential discounts.

Furthermore, it can be beneficial to review your coverage options and consider adjusting them to better suit your needs. As a 50-year-old driver, you may find that you no longer need certain types of coverage, such as collision or comprehensive, if you have paid off your car or it has significantly depreciated in value. By reducing or eliminating unnecessary coverage, you can potentially lower your premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Mistakes To Avoid When Purchasing Car Insurance As A 50-Year-Old Driver

When purchasing car insurance, it’s important to avoid common mistakes that can lead to higher premiums or inadequate coverage. One common mistake is failing to compare quotes from different insurers. Another mistake is not reviewing the policy details and coverage limits carefully. Additionally, be sure to disclose any important information accurately to avoid potential issues when filing a claim.

Furthermore, it’s crucial to be aware of any discounts or special programs available to you as a 50-year-old driver. Many insurance companies offer discounts for mature drivers who have completed defensive driving courses or have a clean driving record. Taking advantage of these opportunities can help you save money on your premiums while still maintaining adequate coverage.

Consider your driving habits and history when choosing a deductible amount. A clean driving record may warrant a higher deductible, while a history of accidents or high-traffic area residency may necessitate a lower one. Regularly reviewing and adjusting your deductible to reflect changes in your finances or driving habits is advisable.

The Impact Of Driving Record And Claims History On Car Insurance Rates For 50-Year-Old Drivers

Your driving record and claims history significantly impact car insurance rates. Insurance companies consider previous accidents, traffic violations, and claims. Maintaining a clean record as a 50-year-old driver can lead to lower premiums. Rates may be higher with a history of accidents or claims, but some insurers offer accident forgiveness programs or consider more recent incidents, so shopping around is essential.

Exploring Additional Coverage Options That Might Benefit 50-Year-Old Drivers

In addition to standard coverage options, there are additional coverage options that may benefit 50-year-old drivers. For example, if you have an aging vehicle, you may want to consider comprehensive coverage to protect against non-collision incidents such as theft or vandalism.

Additionally, roadside assistance coverage can provide peace of mind in case of a breakdown. Consider your specific needs and circumstances when exploring these additional coverage options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Car Insurance for 50-Year-Old Drivers

Explore how tailored solutions from leading insurance providers cater to the unique needs of 50-year-old drivers, offering affordable protection and peace of mind.

- Case Study #1 – Tailored Coverage Solutions for Affordable Protection: John, a 50-year-old driver with a clean record, sought affordable car insurance. State Farm’s personalized approach impressed him. With their tailored coverage options, he secured full coverage for just $120 per month. Their exceptional customer service made the process seamless, earning John’s trust and loyalty.

- Case Study #2 – Innovative Solutions for High-Risk Drivers: After multiple accidents, Sarah, a 50-year-old driver, faced steep insurance rates. Progressive’s online tools and competitive rates caught her attention. Despite her history, she obtained full coverage for $160 monthly. Progressive’s innovative approach and accident forgiveness policy provided Sarah with peace of mind.

- Case Study #3 – Budget-Friendly Coverage With Comprehensive Protection: David, a budget-conscious 50-year-old driver, prioritized affordability without compromising coverage. Nationwide’s usage-based discount program fit his needs perfectly. With their comprehensive protection and usage discount, he secured full coverage for just $150 per month, ensuring both savings and peace of mind.

These case studies underscore the importance of tailored insurance solutions in meeting the diverse needs of 50-year-old drivers, emphasizing affordability and comprehensive coverage.

Heidi Mertlich Licensed Insurance Agent

By understanding individual circumstances and offering innovative approaches, insurance providers ensure peace of mind on the road.

Understanding the Importance of Comprehensive Coverage for Aging Vehicles as a 50-Year-Old Driver

As a 50-year-old driver with an aging vehicle, comprehensive coverage becomes particularly important. Comprehensive coverage protects against damage or loss caused by incidents other than collisions, such as theft, vandalism, or natural disasters. It ensures that you’re financially protected in case of unexpected events that may cause significant damage to your vehicle.

We hope this comprehensive guide has shed light on finding the cheapest car insurance for 50-year-old drivers. Remember to compare quotes, understand your coverage options, and take advantage of available discounts. By following these steps, you can secure the right car insurance at an affordable price.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

What is the best car insurance for 50-year-olds?

The best car insurance for 50-year-olds can vary based on individual needs and preferences, but popular options include State Farm, Progressive, and Nationwide.

Where can I find the best car insurance for 50-year-olds?

You can find the best car insurance for 50-year-olds by comparing quotes from different insurance providers and considering factors such as coverage options, rates, and customer reviews.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

How do I get cheap car insurance for drivers over 50?

To get cheap car insurance for drivers over 50, consider factors such as your driving record, the type of vehicle you drive, and available discounts for mature drivers offered by insurance companies.

Check out our ranking of the top providers: Best Car Insurance by Vehicle

What are the cheapest car insurance options for over 50s?

Some of the cheapest car insurance options for over 50s include State Farm, Progressive, and Nationwide, which offer competitive rates tailored to the needs of mature drivers.

Is there cheap car insurance specifically for 50-year-olds?

Yes, many insurance companies offer discounted rates and tailored coverage options specifically for 50-year-olds, helping them find affordable car insurance that meets their needs.

How can I find cheap car insurance for over 50s?

You can find cheap car insurance for over 50s by comparing quotes from different insurers, exploring available discounts for mature drivers, and considering factors such as coverage limits and deductibles.

For additional details, explore our comprehensive resource titled “Best Car Insurance Discounts to Ask.”

Are there discounts available for car insurance for 50-year-olds?

Yes, many insurance companies offer discounts for car insurance for 50-year-olds, including safe driver discounts, multi-policy discounts, and discounts for completing defensive driving courses.

What factors affect the cost of car insurance for 50-year-olds?

Factors such as driving record, type of vehicle, location, coverage options, and credit score can all affect the cost of car insurance for 50-year-olds.

Why is it important for 50-year-olds to have car insurance?

Car insurance is important for 50-year-olds to protect themselves and their vehicles financially in case of accidents, theft, or other unexpected events on the road.

To delve deeper, refer to our in-depth report titled “Car Accidents: What to do in Worst Case Scenarios.”

How can I switch to a cheaper car insurance provider as a 50-year-old driver?

To switch to a cheaper car insurance provider as a 50-year-old driver, compare quotes from different insurers, consider coverage options and discounts, and ensure a smooth transition by canceling your current policy properly.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.