Best Business Insurance for Welders in 2026 (Your Guide to the Top 10 Providers)

The best business insurance for welders comes from Progressive, Chubb, and Travelers, offering solid business coverage for welders starting at about $40 per month. These companies offer full protection with up to 20% in discounts, giving welders the best welding insurance and reliable support for their business.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Joel Ohman

Updated June 2025

13,285 reviews

13,285 reviewsCompany Facts

General Liability

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 82 reviews

82 reviewsCompany Facts

General Liability

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 1,734 reviews

1,734 reviewsCompany Facts

General Liability

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsProgressive offers the best business insurance for welders, offering competitive and affordable coverage rates with discounts of up to 20%. Our comprehensive guide explores the essential aspects of business insurance for welders, covering key coverage options and expert tips.

Our Top 10 Company Picks: Best Business Insurance for Welders

| Company | Rank | A.M. Best | Business Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A+ | 20% | Affordable Options | Progressive | |

| #2 | A++ | 18% | Global Reach | Chubb | |

| #3 | A++ | 18% | General Liability | Travelers | |

| #4 | A+ | 16% | Equipment Breakdown | The Hartford |

| #5 | A | 16% | Comprehensive Coverage | Liberty Mutual |

| #6 | A++ | 15% | Local Presence | State Farm | |

| #7 | A+ | 15% | Customizable Coverage | Allstate | |

| #8 | A++ | 12% | Online Convenience | Geico | |

| #9 | A | 12% | Equipment Coverage | Farmers | |

| #10 | A+ | 10% | Customer Service | Hiscox |

With a focus on general liability, equipment insurance, and commercial auto coverage, Progressive stands out for its reliability and affordability, ensuring welders receive the comprehensive protection they need to thrive in their industry.

Chubb ranks second for its strong global coverage and high-end protection plans. Travelers is third, known for excellent general liability coverage with flexible policy options.

If you want the best welding insurance, these three are great picks for keeping your welding business protected. Enter your ZIP code above to get started on comparing business insurance quotes.

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive offers up to a 20% business insurance discount, making it an affordable choice for welders.

- Flexibility in Coverage: Progressive insurance review & ratings highlight the company’s reputation for accommodating welders by tailoring coverage to their individual requirements.

- Additional Savings: With an extra discount of up to 15%, Progressive provides businesses with opportunities for additional savings.

Cons

- Limited Global Reach: Progressive’s global reach might be more restricted compared to some competitors.

- Potential Restrictions: Some businesses may face restrictions or eligibility criteria for accessing maximum discounts.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Chubb: Best for Global Assurance

Pros

- Extensive Global Presence: Chubb’s international presence makes it a good fit for welders with global business operations.

- Substantial Discounts: Chubb demonstrates commitment with up to an 18% business insurance discount.

- Comprehensive Coverage: Chubb insurance review & ratings cover a broad spectrum of options, providing welders with extensive protection choices.

Cons

- Higher Premiums: Chubb’s premiums might be relatively higher compared to some competitors.

- Less Local Focus: Chubb may have a less pronounced local presence compared to some competitors.

#3 – Travelers: Best for General Liability

Pros

- Specialization in General Liability: Travelers insurance review & ratings underscores the company’s strong suit in providing comprehensive general liability coverage, safeguarding against a wide array of potential risks.

- Balanced Discounts: Providing up to 18% business insurance discount, Travelers balances affordability with savings.

- Customized Plans: Travelers allows for customized plans tailored to specific needs and industry requirements.

Cons

- Limited Specialized Coverage: Travelers may not provide as much depth in specialized coverages.

- Potential Complexity: The range of customization options may lead to complexity in understanding the coverage.

#4 – The Hartford: Best for Equipment Breakdown

Pros

- Emphasis on Equipment Breakdown Coverage: The Hartford provides up to 16% business insurance discount with a focus on equipment-related risks.

- Reliable Coverage: Known for reliability, The Hartford ensures coverage for welders reliant on specialized tools and machinery.

- Customer Support: The Hartford insurance review & ratings emphasize the company’s reputation for excellent customer support.

Cons

- Limited Specialization Beyond Equipment: The Hartford may not offer as extensive coverage for other aspects of welding businesses.

- Potential for Limited Discounts: Maximum discounts offered may be lower compared to other providers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Reliable Comprehensive Solutions

Pros

- Comprehensive Coverage: Liberty Mutual is known for comprehensive coverage options.

- Flexible Policies: Liberty Mutual’s policies are designed for flexibility to meet specific business needs.

- Solid Reputation: When it comes to Liberty Mutual insurance review & ratings, businesses can rely on its strong reputation for stability and reliability.

Cons

- Higher Cost Potential: While offering comprehensive coverage, premiums may be relatively higher.

- Limited Specialization: Liberty Mutual may not specialize extensively in certain niche areas.

#6 – State Farm: Best for Trusted Local Presence

Pros

- Local Emphasis: State Farm’s local presence makes it suitable for welders preferring a community-oriented insurer.

- Significant Discounts: With up to 15% business insurance discount, State Farm provides substantial savings.

- Varied Coverage Options: State Farm insurance review & ratings encompass various coverage options tailored to individual requirements.

Cons

- Limited Global Reach: State Farm’s global reach may be more restricted compared to some competitors.

- Potential Less Specialization: State Farm may not have the same level of specialization in certain niche areas.

#7 – Allstate: Best for Customizable Coverage

Pros

- Customizable Coverage Options: Allstate stands out for allowing welders to tailor insurance plans to individual business requirements.

- Attractive Discounts: With up to 15% business insurance discount, Allstate offers competitive rates.

- Industry Experience: The credibility of Allstate insurance review & ratings is bolstered by its extensive industry experience.

Cons

- Potential for Complex Policies: The range of customizable options may lead to complex policies.

- Limited Global Presence: Allstate’s global presence may not be as extensive as some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Online Convenience and Affordability

Pros

- Online Convenience: Geico’s online platform offers up to 12% business insurance discount and up to 12% additional discount.

- Affordability: Geico’s emphasis on affordability makes it a compelling choice for budget-friendly solutions. Explore our “How can I pay my GEICO insurance premium?” for more information.

- Simplified Process: Geico streamlines the insurance process for easy coverage access.

Cons

- Limited Specialization: Geico may not offer the same level of specialization in certain niche areas.

- Less Personalized Service: The emphasis on online convenience may result in less personalized service.

#9 – Farmers: Best for Equipment Coverage and Support

Pros

- Equipment Coverage Emphasis: Farmers provides up to 12% business insurance discount with a focus on equipment coverage.

- Customer Support: Farmers insurance review & ratings accentuate the company’s renowned customer support.

- Varied Policy Options: Farmers offers a variety of policy options to align with specific business needs.

Cons

- Higher Premiums Potential: While offering extensive coverage, premiums may be relatively higher.

- Less Global Reach: Farmers’ global presence may not be as extensive.

#10 – Hiscox: Best for Equipment Coverage Specialisation

Pros

- Equipment Coverage Focus: Hiscox provides up to 10% business insurance discount with a focus on equipment coverage.

- Flexible Policies: Hiscox offers flexibility for welders to customize coverage based on specific business requirements.

- Strong Additional Discount: Hiscox provides a substantial additional discount of up to 18%, contributing to potential cost savings.

Cons

- Limited Global Reach: Hiscox may not have the same global reach as some competitors.

- Potential for Higher Premiums: While offering competitive discounts, premiums may be relatively higher. Discover more on our “How does the insurance company determine my premium?” for further insights.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Determining the Cost of the Best Business Insurance for Welders

How much does welding insurance cost? The welding business insurance cost depends on several factors, including the type of work you do and the coverage you choose. A basic welder’s insurance policy usually includes liability and property damage, which helps set the starting price.

Business Insurance Monthly Rates for Welders by Coverage Type

| Company | General Liability | Business Owners Policy | Professional Liability | Commercial Auto |

|---|---|---|---|---|

| $44 | $59 | $65 | $150 |

| $48 | $63 | $69 | $158 |

| $46 | $61 | $67 | $153 |

| $40 | $55 | $62 | $145 |

| $42 | $57 | $64 | $148 |

| $45 | $60 | $66 | $155 |

| $43 | $58 | $63 | $149 |

| $41 | $56 | $61 | $147 |

| $47 | $62 | $68 | $160 |

| $46 | $60 | $65 | $154 |

If you run a mobile business, the mobile welding insurance cost typically covers just one welder to start. As you add more people to your team, the welder insurance cost goes up because each worker adds to the risk. This makes it important to consider team size when planning your business coverage for welders.

Kristine Lee Licensed Insurance Agent

Extra equipment coverage—like tools stored in trucks—can also raise your premium. These added needs are part of why welding insurance is so expensive for some businesses. Costs vary depending on your business size, equipment, and services.

To get the most accurate welding business insurance cost, think about what coverage you need and talk to insurance providers directly. You can also check out our “Best Car Insurance for Commercial Truck Drivers (Top 10 Companies)” for more coverage tips related to business vehicles.

Business Insurance for Welders: Liability & Equipment Coverage

If you’re a welder, having the right insurance can save you a lot of trouble. Welding comes with risks, and insurance helps protect your business, tools, and future. Here’s a simple breakdown of what you need:

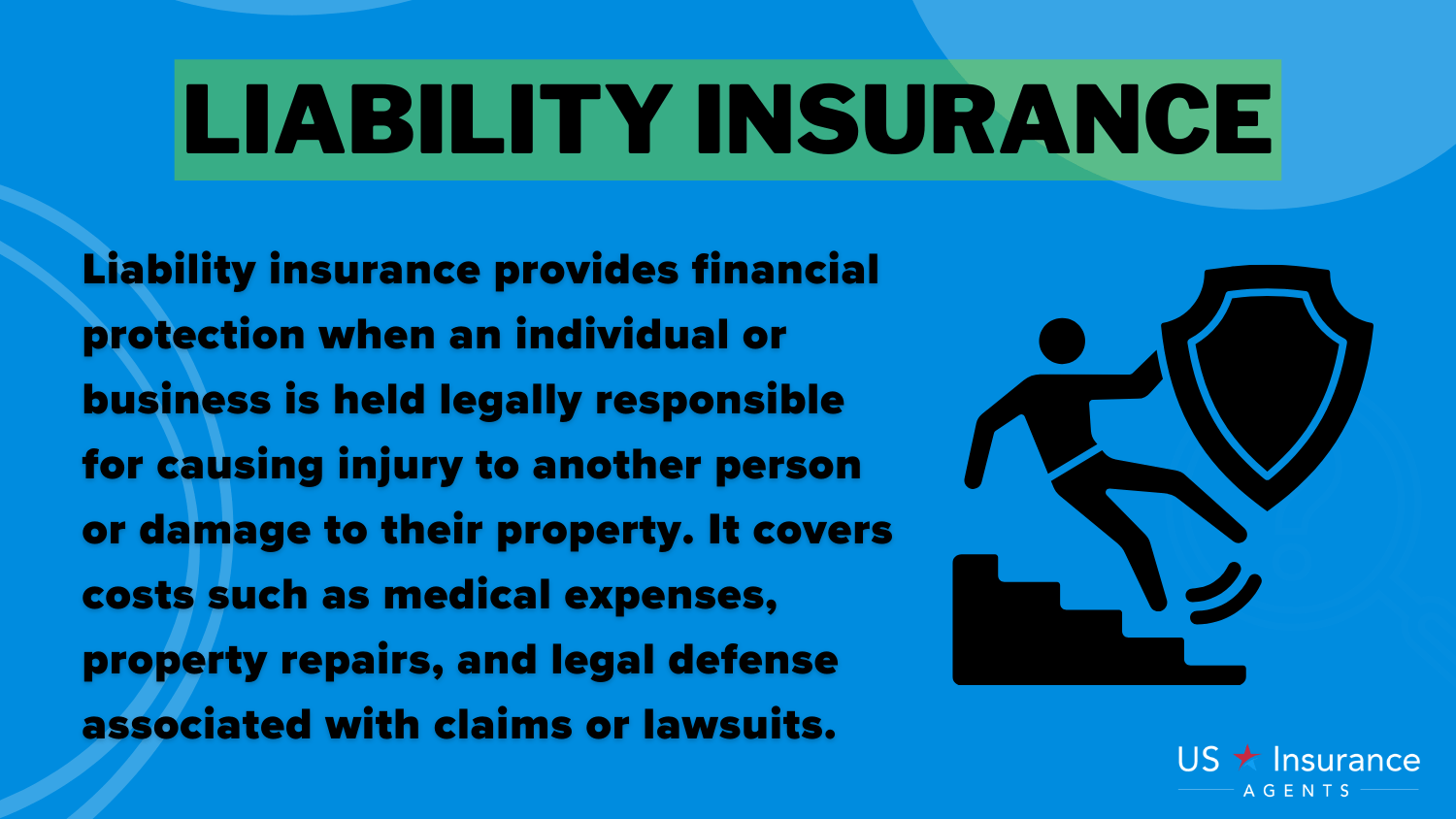

General Liability and Completed Operations

Liability insurance for welders covers injuries or property damage that happens while you’re working. It also covers problems that come up after the job is done.

For example, if you weld a fence on a rooftop and the weld breaks later, causing someone to fall and get hurt, welding liability insurance would help cover medical bills and legal costs.

Many welders ask, how much does LLC insurance cost? It depends on your business, but it’s worth it to avoid paying out of pocket for accidents.

Inland Marine / Equipment Coverage

Welders often use expensive tools like generators or welders mounted on trucks. These can get stolen or damaged on the job or while traveling. Inland marine insurance protects your tools wherever they are.

Give your insurance broker a full list of your equipment and how much it’s worth. That way, you’re covered if anything goes missing or gets damaged.

Read more: Best Insurance Companies

Commercial Auto and Trailer Insurance

If you drive a work truck or pull a trailer to get to job sites, you’ll need commercial auto insurance. It covers accidents, damage, and liability while you’re driving for work.

Many welders go for more coverage, like a $1,000,000 liability insurance policy, to make sure they’re fully protected. The price depends on the type of vehicle and how you use it, but the extra coverage can really help in a bad situation.

Having liability insurance for welders and other key coverages helps protect your business from accidents, tool damage, or legal trouble. Talk to your insurance provider about the right coverage for your work, and make sure you’re protected both on the job and after it’s done.

Business Insurance for Welders: Extra Protection for Welders

When looking for the best business insurance for welders, it’s important to go beyond basic coverage. Adding endorsements like the blanket additional insured and waiver of subrogation can provide added protection and meet client requirements.

- Blanket Additional Insured Endorsement: This is an automatic endorsement that adds your clients as additional insureds under your policy, freeing up your time and possibly lowering premiums. It is a must-have addition to welding liability insurance and pool installer insurance. It’s easy to add this coverage with Next Insurance, a reliable provider.

- Waiver of Subrogation Endorsement: This endorsement ensures that your insurance company won’t pursue your clients to recover claim costs. It helps protect your business relationships and is often required in contracts. Next Insurance can tailor your policy to include this valuable endorsement for added peace of mind.

Including these recommendations in your welding liability insurance demonstrates your dedication to safeguarding your business and customers.

Do you *actually* need #WorkersCompensation for your business? 🤔 Some businesses *have* to have it, while others might be exempt – like solo business owners, tiny teams, or family-run businesses. It all depends on where you live and what type of work you do!

But here’s the… pic.twitter.com/EFqpm4Vi1E

— NEXT Insurance (@nextInsurance1) April 9, 2025

Next Insurance provides adaptable policies that suit your unique requirements and offer extensive coverage.

Read more: What is comprehensive coverage?

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Welders’ Business Insurance: Maximize Coverage and Minimize Risk

When it comes to small business insurance, understanding your policy is key to protecting your welding business. Pay attention to subcontractor clauses and product-related limits to make sure you have the right coverage.

- Check Your Policy: Look for any subcontractor exclusions or limitations. Missing these can leave your business exposed.

- Verify Coverage: Ensure that subcontractors carry their own insurance or have them obtain welding contractor insurance.

- Certificate Maintenance: Regularly request and maintain certificates of insurance from subcontractors to validate their coverage.

- Know Product Limitations: Understand product exclusions under your policy so you understand your risks.

- Identify Product Restrictions: Take note of any restrictions associated with your products and their risks.

- Consider More Protection: Talk to your insurance provider about options like product liability insurance for better coverage.

By making sure your best welding insurance covers subcontractors and product limitations, and even considering Geico business insurance for flexibility, you can manage risks and run a secure welding business.

How to Get the Best Business Insurance for Welders Online

Getting the right insurance for your welding business online is simple if you follow a few easy steps. Here’s how to find the best business insurance for welders and make sure your business is covered:

- Visit the Insurance Provider’s Website: Go to the official website of the insurance company you’re interested in.

- Find the Quote Tool: Look for the section where you can request a quote. It’s often clearly marked and easy to use.

- Fill Out and Submit the Form: Enter your business info—like location, size, and years in operation—to get a quote and see your welder insurance cost.

- Review and Compare Quotes: Look closely at what each policy offers and compare prices to find the best fit.

- Finalize the Purchase: Pick the coverage that works for you and complete the purchase online or speak with an agent.

With a few clicks, you can easily get the best business insurance for welders and protect your business from unexpected risks

Read more: Insurance Quote Online

Case Study: How Business Insurance Empowers Welding Businesses

These case studies highlight real-world scenarios where having appropriate insurance coverage proved invaluable for welding businesses. From property damage to liability claims, these examples underscore the necessity of comprehensive insurance protection in the welding industry.

- Case Study # 1 – Property Damage Mitigation: Precision Welding Services faced a welding project causing a metal railing collapse, resulting in substantial property damage. Their liability insurance covered repair costs and potential claims.

- Case Study # 2 – Equipment Protection: Welding Solutions LLC experienced machinery damage during transportation to a job site. Their equipment insurance facilitated financial recovery.

- Case Study # 3 – Commercial Auto Liability: Precision Welding Services heavily relied on its truck fleet for material transport. An accident occurred, but their auto insurance provided essential liability coverage, shielding them from significant financial losses. Discover more in our “Fleet Vehicle Insurance: A Complete Guide“.

These case studies vividly demonstrate the diverse risks faced by welding businesses and how having the right insurance coverage can mitigate these risks.

Jeffrey Manola Licensed Insurance Agent

By prioritizing insurance and risk management, welding businesses can safeguard their assets, reputation, and long-term success.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Securing the Best Business Insurance for Welders

Finding the best business insurance for welders can be tough. There aren’t many options, and some policies don’t cover welding well or treat it as high-risk. But by understanding what you need and working with an agent who knows the industry, you can get good protection.

Start with the basics: general liability, equipment (inland marine), and commercial auto insurance. These cover things like injuries, property damage, stolen tools, and accidents with your work truck. If you also do metal work, welding and fabrication insurance offers extra protection.

If you’re in Massachusetts, welder’s insurance is important because the state has specific rules for coverage. You might also need a welding contractor’s insurance in Massachusetts to meet local job site requirements.

Remember to check for extras like additional insured endorsements, subcontractor rules, and product exclusions to avoid any gaps. Ultimately, the best type of insurance for a welder protects you and lets you focus on your work with peace of mind.

Read more: Best Business Insurance for Insurance Agents

Our free quote tool below makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

Frequently Asked Questions

What types of coverage are essential for welding business insurance?

General liability, inland marine/equipment insurance, and commercial auto coverage are fundamental for protecting against bodily injury, property damage, theft, and accidents.

For additional details, delve into our “Commercial Insurance: A Complete Guide“.

How is the cost of welding insurance determined?

The welding business insurance cost is influenced by factors such as the type of coverage, the number of welders, and equipment coverage. Consulting with providers helps obtain accurate quotes tailored to specific business needs.

Protect your company and employees with adequate coverage — enter your ZIP code below to instantly compare commercial insurance quotes with our free comparison tool.

What endorsements can enhance insurance coverage for welders?

Blanket Additional Insured and Waiver of Subrogation endorsements provide added protection and flexibility. They extend coverage to clients and waive reimbursement rights, respectively.

How can welding businesses navigate product limitations or exclusions in their insurance policies?

Thoroughly reviewing policies and consulting with providers helps understand product-related limitations or exclusions. This enables businesses to assess potential coverage gaps and take appropriate measures.

Why is it crucial to review subcontractor exclusions in welding insurance policies?

Exclusions or limitations for work performed by subcontractors can expose the business to risks. Confirming coverage for subcontracted work or requiring subcontractors to carry their insurance is vital.

Dig deeper into our “Best Health Insurance For Welders” for more insights.

How much does welding business insurance typically cost?

The cost varies but starts around $40/month for general liability. Final premiums depend on team size, equipment value, business location, and additional coverages like commercial auto or inland marine.

What does general liability insurance cover for welders?

It covers claims for property damage, bodily injuries, and legal defense costs resulting from welding operations—both during the job and after completion.

What is a “Blanket Additional Insured Endorsement”?

It automatically adds clients or contractors to your policy as additional insureds, often required by job contracts. It’s a common and helpful add-on for welders working with larger businesses or municipalities.

Explore further on our “Best Business Insurance for Manufacturing Companies (Top 10 Companies)“.

Why is Progressive ranked the best for welding business insurance?

Progressive stands out for its competitive rates, up to 20% discounts, and flexible policy options tailored to welders. It offers coverage for general liability, equipment, and commercial auto in a single package.

Our free comparison tool makes it easy to stick to your business insurance budget – enter your ZIP code below to get started.

What is equipment (inland marine) coverage, and why is it important for welders?

Equipment coverage protects tools and machines (e.g., welders, generators) from theft or damage during transport or on job sites. It’s critical for mobile welders and contractors with valuable gear. Finding the best insurance company would be vital for your success.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.