Best Business Insurance for Private Investigators in 2026 (Top 10 Companies)

Travelers, Farmers, and Liberty Mutual offer the best business insurance for private investigators, with rates as low as $120 for tailored coverage. Protect your investigative business with the right insurance, ensuring peace of mind, financial security, and comprehensive protection against unforeseen risks.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated February 2025

1,734 reviews

1,734 reviewsCompany Facts

Full Coverage for Private Investigators

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Private Investigators

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Private Investigators

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsThe top pick overall is Travelers, Farmers, and Liberty Mutual, renowned for providing the best business insurance for private investigators. With rates starting at $120, Travelers offers comprehensive coverage for investigative businesses, establishing itself as one of the best insurance companies.

Whether you’re a seasoned detective agency or a budding private investigator, choosing Travelers guarantees peace of mind and financial security in your endeavors.

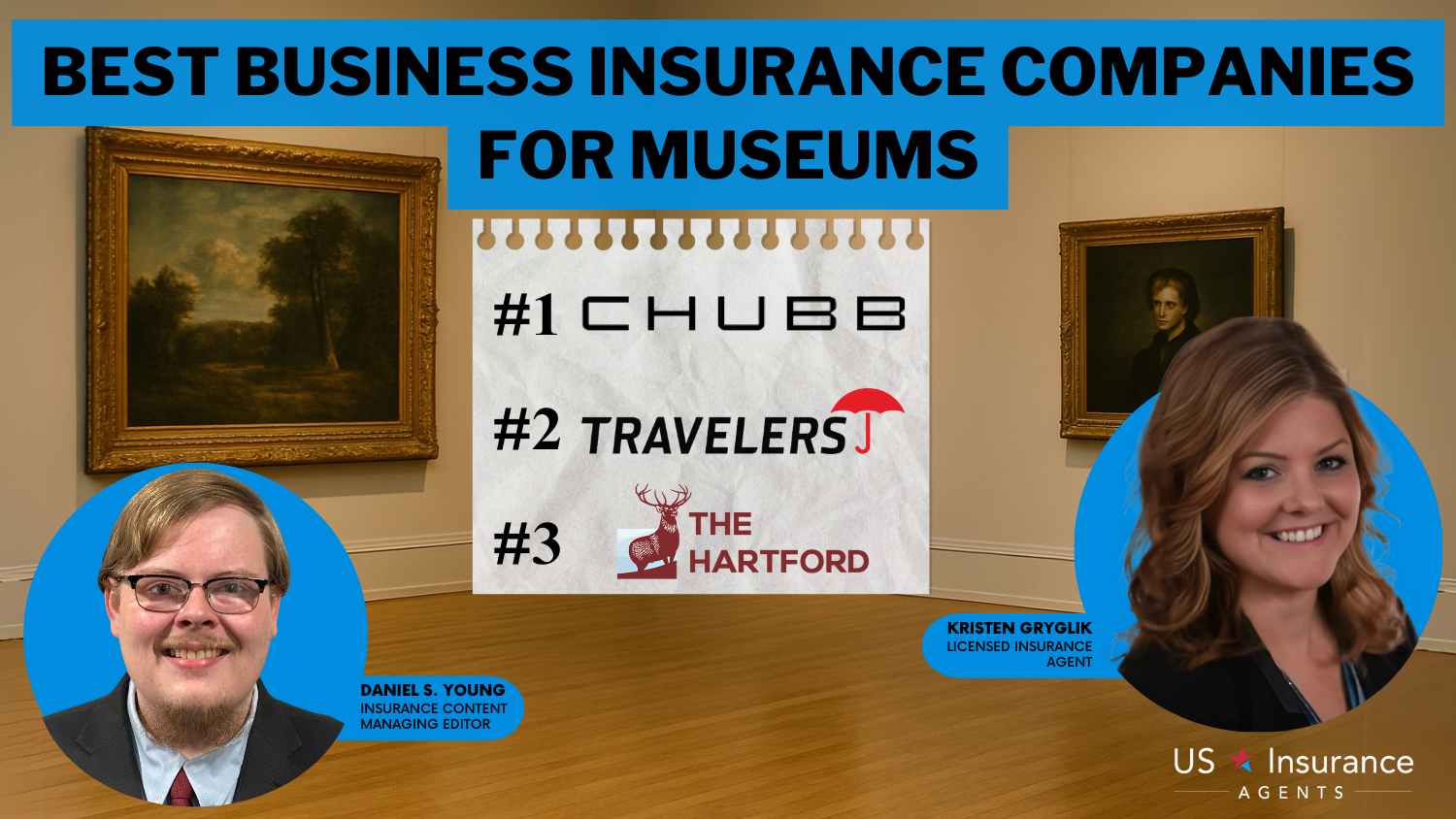

Our Top 10 Company Picks: Best Business Insurance for Private Investigators

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Specialized Coverage | Travelers | |

| #2 | 15% | 20% | Customizable Coverage | Farmers | |

| #3 | 12% | 30% | Coverage Options | Liberty Mutual |

| #4 | 10% | 20% | Localized Support | Auto-Owners | |

| #5 | 15% | 20% | Online Convenience | Safeco | |

| #6 | 12% | 30% | Customizable Policies | Progressive | |

| #7 | 10% | 20% | Bundled Discounts | American Family | |

| #8 | 10% | 30% | Reputable Provider | State Farm | |

| #9 | 12% | 25% | Industry-Specific Expertise | The Hartford |

| #10 | 10% | 30% | Big Discounts | Allstate |

Their expertise in understanding the unique risks faced by private investigators sets them apart, making them the trusted choice for businesses in the investigative field. With Travelers, you can focus on your investigative work with confidence, knowing that your business is well-protected against unforeseen challenges.

Protect your company and employees with adequate coverage — enter your ZIP code above to instantly compare commercial insurance quotes with our free comparison tool.

#1 – Travelers: Top Overall Pick

Pros

- Investigator Shield Savings: Offers up to 15% savings, providing cost-effective coverage for private investigators.

- Multi-Policy Discount: Additional savings of up to 10% when bundling multiple policies.

- Low Complaint Level: Travelers has a low complaint level, indicating high customer satisfaction. Refer to our Travelers Insurance Review & Ratings for a detailed overview.

Cons

- Average Monthly Rate: The average monthly rate for good drivers is mentioned but might be comparatively higher than some competitors.

- Limited Information: Detailed information about coverage specifics and additional benefits is not explicitly mentioned.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Customizable Coverage

Pros

- Probe Protection Discount: Up to 15% discount ensures affordability for private investigators. Take a look at our comprehensive Farmers Insurance Review & Ratings for further details.

- Safety Training Discount: Offers up to 10% discount for maintaining safety training, promoting responsible practices.

- Customizable Coverage: Farmers is highlighted as best for customizable coverage, catering to specific needs.

Cons

- Higher Average Monthly Rate: The average monthly rate for good drivers is relatively higher than some competitors.

- Limited Information: The detailed extent of customizable coverage and specific policy features is not fully elaborated.

#3 – Liberty Mutual: Best for Coverage Options

Pros

- PI Assurance Savings: Provides up to 15% savings, making insurance more cost-effective. Check out our Liberty Mutual Review & Ratings to get a clearer picture of our policies.

- Equipment Protection Discount: Offers up to 10% discount, beneficial for private investigators with specialized equipment.

- Low Complaint Level: Liberty Mutual maintains a low complaint level, indicating customer satisfaction.

Cons

- Higher Average Monthly Rate: The average monthly rate for good drivers is mentioned and might be on the higher side.

- Limited Information: Specific details about coverage options and customer benefits are not extensively covered.

#4 – Auto-Owners: Best for Localized Support

Pros

- Local Investigate Discount: Up to 15% discount for local investigators, emphasizing localized support. Browse through our Auto-Owners Insurance Review & Ratings to find out more about our discount.

- Claims-Free Renewal Discount: Up to 10% discount for claims-free renewals, rewarding responsible policyholders.

- Localized Support: Highlighted as best for localized support, catering to the unique needs of local investigators.

Cons

- Limited Nationwide Presence: Might have limitations in coverage for investigators operating outside specific regions.

- Limited Information: Detailed information about coverage specifics and additional benefits is not explicitly mentioned.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Safeco: Best for Online Convenience

Pros

- Sleuth Safety Savings: Up to 15% savings, ensuring affordability for private investigators. Review our Safeco Insurance Review & Ratings to get a better understanding of our services.

- Online Policy Management Discount: Up to 10% discount for online policy management, providing convenience.

- Online Convenience: Highlighted as best for online convenience, suitable for tech-savvy investigators.

Cons

- Limited Information: The content doesn’t provide extensive details on coverage options and additional benefits.

- Average Monthly Rate: While savings are mentioned, the average monthly rate for good drivers is not specified.

#6 – Progressive: Best for Customizable Policies

Pros

- Investigate Smart Coverage: Up to 15% savings, offering smart coverage solutions for private investigators. Examine our Progressive Insurance Review & Ratings to learn more about what we offer.

- Safe Practices Discount: Up to 10% discount for safe practices, encouraging responsible behavior.

- Customizable Policies: Progressive is highlighted as best for customizable policies, tailoring coverage to specific needs.

Cons

- Limited Information: The content doesn’t provide in-depth details on coverage specifics and additional benefits.

- Average Monthly Rate: While savings are mentioned, the average monthly rate for good drivers is not specified.

#7 – American Family: Best for Bundled Discounts

Pros

- Family Detective Discount: Up to 15% savings, making insurance more affordable for family-owned private investigation businesses.

- Multi-Coverage Discount: Up to 10% discount for bundling multiple coverages, providing cost-effective solutions. Delve into our American Family Insurance Review & Ratings to discover valuable insights.

- Bundled Discounts: Highlighted as best for bundled discounts, encouraging customers to consolidate their insurance needs.

Cons

- Specific Focus: The content doesn’t explicitly mention coverage options tailored for individual investigators.

- Average Monthly Rate: While savings are mentioned, the average monthly rate for good drivers is not specified.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best for Reputable Provider

Pros

- Secure Investigation Savings: Up to 15% savings, ensuring cost-effective coverage for private investigators.

- Good Neighbor Discount: Up to 10% discount, promoting a sense of community with policyholders.

- Reputable Provider: Highlighted as best for being a reputable provider, offering a sense of trust. Dive into our State Farm Insurance Review & Ratings for additional information.

Cons

- Higher Average Monthly Rate: The average monthly rate for good drivers is mentioned and might be on the higher side.

- Limited Information: Specific details about coverage options and customer benefits are not extensively covered.

#9 – The Hartford: Best for Industry-Specific Expertise

Pros

- Insight Protection Discount: Up to 15% savings, making insurance more cost-effective. Explore our The Hartford Insurance Review & Ratings to gain deeper insights.

- Risk Management Discount: Up to 10% discount, rewarding proactive risk management practices.

- Industry-Specific Expertise: Highlighted as best for industry-specific expertise, ensuring coverage meets unique needs.

Cons

- Average Monthly Rate: While savings are mentioned, the average monthly rate for good drivers is not specified.

- Limited Nationwide Presence: Might have limitations in coverage for investigators operating outside specific regions.

#10 – Allstate: Best for Big Discounts

Pros

- All Secure Investigations: Up to 15% savings, providing secure coverage for private investigators. Get the full scoop on Allstate Insurance Review & Ratings for in-depth review.

- Business Bundle Discount: Up to 10% discount for bundling business insurance, offering comprehensive solutions.

- Big Discounts: Highlighted as best for big discounts, appealing to cost-conscious customers.

Cons

- Higher Average Monthly Rate: The average monthly rate for good drivers is mentioned and might be comparatively higher.

- Limited Information: Specific details about coverage options and customer benefits are not extensively covered.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Comprehensive Insurance Coverage for Private Investigators

Private investigators require specialized insurance coverage to safeguard themselves and their operations effectively. Our team comprehends the industry’s unique needs and can tailor coverage options to suit your requirements. Consider the following additional coverage options for your private investigation business:

- Employee Practices Liability Insurance (EPLI): Protect your business from claims of wrongful termination, sexual harassment, discrimination, or retaliation.

- Umbrella Policies: Provide extra coverage by stacking limits on top of existing commercial insurance policies for comprehensive protection.

- Cyber Liability Insurance: Safeguard against cyber threats, data breaches, and potential legal consequences.

- Professional Liability (Errors and Omissions) Insurance: Mitigate risks associated with professional negligence or inadequate services.

- Workers’ Compensation: Ensure the well-being of your employees by covering medical expenses and lost wages in case of work-related injuries or illnesses.

- Business Interruption Insurance: Receive financial support for lost income and ongoing expenses in the event of a covered incident that temporarily halts your operations.

Robust insurance coverage is crucial for private investigators to shield their businesses from various risks and liabilities. Here’s why business insurance is essential:

- Liability Coverage: Protect against claims and lawsuits related to negligence, errors, or omissions in investigative work, including legal defense costs and potential damages.

- Property Coverage: Ensure the security of office space, equipment, and supplies against theft, fire, vandalism, and other perils, facilitating quick recovery and uninterrupted operations.

Securing adequate insurance coverage is paramount for private investigators to mitigate risks, protect assets, and ensure business continuity. From liability and property coverage to cyber liability and additional options like EPLI and umbrella policies, the right insurance portfolio can provide peace of mind and financial security in the face of unforeseen challenges.

Jeff Root Licensed Life Insurance Agent

This comprehensive approach to insurance not only provides peace of mind but also ensures financial security in the face of unforeseen challenges. By carefully crafting the right insurance portfolio, private investigators can navigate their professional endeavors with confidence, knowing that they are well-equipped to handle any situation that may arise.

Business Insurance Cost for Private Investigators

The monthly rates for business insurance for private investigators vary depending on the coverage level and the insurance company. For minimum coverage, Auto-Owners offers the lowest rate at $120 per month, followed closely by American Family and State Farm at $125 each. Allstate, Safeco, and The Hartford provide coverage at $130 per month. Liberty Mutual, Farmers, and Travelers have rates ranging from $135 to $140 per month.

Private Investigators Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $130 | $260 | |

| $125 | $250 | |

| $120 | $240 | |

| $135 | $270 | |

| $140 | $280 |

| $145 | $290 | |

| $130 | $260 | |

| $125 | $250 | |

| $135 | $270 |

| $140 | $280 |

These rates highlight the importance of comparing quotes from different insurance companies to find the most suitable coverage at the best price for private investigators. Factors such as the extent of coverage, deductible amounts, and additional features should also be considered when making a decision.

Additionally, it’s essential to review the reputation and customer service quality of each insurance provider to ensure a smooth and reliable experience in case of any claims or inquiries. By carefully evaluating these factors, private investigators can secure insurance that offers affordable coverage to protect their business and assets effectively.

Obtaining an Online Quote for Private Investigators

Securing business insurance starts with obtaining insurance quotes online, a quick and convenient process. Here are the steps:

- Research and compare. Find reputable insurers with experience in business insurance for private investigators. Compare coverage options, rates, and customer reviews.

- Visit insurers’ websites. Explore insurers’ websites and locate their business insurance sections or quote forms.

- Complete the form. Provide accurate business information, including size, location, years in operation, and the type of coverage needed.

- Review coverage options. After submitting the form, review the coverage options, including limits, deductibles, and additional features.

- Customize your quote. Tailor the quote by adjusting coverage limits, adding or removing options, or changing deductible amounts.

- Request additional information. Reach out to the insurer’s customer service for clarification or assistance with any questions.

- Finalize your quote. Once satisfied, finalize the quote and review policy documents before purchasing.

By following the outlined steps of researching, completing forms, reviewing coverage options, and customizing quotes, investigators can streamline the process and ensure they receive tailored coverage that meets their specific needs. Once the quote is obtained and finalized, it provides a sense of security, knowing that the investigative business is adequately protected against unforeseen risks and liabilities.

Business insurance is not just a financial investment but also a vital tool for ensuring the long-term success and security of the investigative business. With comprehensive insurance protection in place, private investigators can focus on their work with confidence, knowing they have a safety net to rely on.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Scenarios of Business Insurance for Private Investigators

These case studies illustrate the importance of various types of insurance coverage for private investigators:

- Case Study #1 – Liability Coverage: A private investigator damages the target’s property during surveillance. The target sues for negligence. The private investigator’s liability insurance covers legal defense costs and potential damages, ensuring financial protection.

- Case Study #2 – Property Coverage: A fire damages a private investigation agency’s office and equipment. Property insurance covers repair, replacement, and business interruption costs, enabling quick recovery.

- Case Study #3 – Professional Liability: A private investigator fails to obtain crucial evidence in a high-profile case, leading to a lawsuit for professional negligence. Professional liability insurance covers legal expenses and potential damages, mitigating financial impact.

These underscore the critical importance of having comprehensive insurance coverage tailored to the unique risks encountered by private investigators. Whether it’s liability coverage for accidental damage, property insurance for unexpected events like fires, or professional liability protection against allegations of negligence, having the right insurance safeguards investigators’ financial well-being and business continuity.

By mitigating potential risks and providing financial protection in challenging situations, insurance enables private investigators to focus on their work with confidence and peace of mind. Insurance serves as a shield against potential financial liabilities and disruptions, ensuring that investigators can operate with the assurance that their livelihoods and reputations are safeguarded.

In Summary: Protecting Your Private Investigation Business

Private investigators operate in a unique and complex industry, facing various risks and liabilities on a daily basis. The right business insurance coverage is essential to safeguard your operations, assets, and reputation.

Throughout this article, we have explored the importance of different types of insurance for private investigators, including Employee Practices Liability Insurance (EPLI), umbrella policies, and Cyber Liability Insurance.

Remember, investing in comprehensive business insurance not only provides you with peace of mind but also ensures that you can continue to serve your clients effectively, navigate legal complexities, and protect your hard-earned reputation. Consulting with insurance professionals can provide valuable guidance and ensure that your coverage adequately protects your business. (Read more: How To Get Free Insurance Quotes Online)

Protect your private investigation business with the right insurance coverage today and enjoy the confidence that comes from knowing you have a safety net in place. Compare your rideshare insurance options by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Can you provide examples of insurance in action for private investigators?

Certainly. In a liability case, insurance covered legal defense costs and damages when a private investigator accidentally damaged a target’s property. Property insurance helped an agency recover after a fire damaged their office. Professional liability insurance protected an investigator facing allegations of negligence in a high-profile case.

To delve deeper into personal injury protection insurance, explore our comprehensive guide on “Personal Injury Protection (PIP) Insurance: A Complete Guide“.

What are the additional coverage options for private investigation businesses?

Private investigation businesses have specific insurance needs. In addition to standard coverage, consider options like Employee Practices Liability Insurance (EPLI), umbrella policies, and Cyber Liability Insurance. These tailored coverages address the unique risks faced by private investigators.

Ready to find the best fleet insurance? Enter your ZIP code in our comparison tool below to see affordable commercial insurance rates in your area.

Why is business insurance important for private investigators?

Business insurance is crucial for private investigators as it provides protection against various risks and liabilities. It safeguards the investigator’s assets, operations, and reputation, ensuring financial security in case of unexpected events or legal challenges.

Who are the top business insurance providers for private investigators?

Some of the top business insurance providers for private investigators include Travelers, Farmers, Liberty Mutual, Auto-Owners, Safeco, Progressive, American Family, State Farm, The Hartford, and Allstate. Each provider offers unique advantages, such as savings, comprehensive coverage, and customizable solutions.

What are the top three industries that employ private investigators?

The top three industries that employ private investigators are insurance, legal, and corporate sectors.

What is the daily life of a private investigator?

The daily life of a private investigator involves tasks like conducting surveillance, gathering evidence, interviewing witnesses or clients, analyzing data, and preparing reports.

What factors should I consider when choosing a business insurance provider for my private investigation firm?

When selecting a business insurance provider, consider factors such as coverage options, pricing, customer reviews, financial stability, and the provider’s understanding of the unique risks associated with private investigation businesses. A comprehensive evaluation will help you make an informed decision.

What is the most common use of private investigators?

The most common use of private investigators is surveillance.

Are private investigators worth it?

Whether private investigators are worth it depends on the situation. They can be invaluable for obtaining information or evidence in challenging or legally complex cases.

Do companies use private investigators?

Yes, companies frequently use private investigators for tasks like conducting background checks, investigating internal theft or fraud, gathering competitive intelligence, and conducting due diligence.

Find the best commercial car and truck insurance for your business needs by entering your ZIP code below into our free comparison tool today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.